Each year the editors of WorkBoat put together our Top 10 news stories of the year. The workboat industry may be small compared to others, but there's plenty of action throughout the year. As usual, getting the number down to 10 was a challenge, but we think we've put together a list that will pique your interest. So, below please find our list in descending order from 10 to one for 2019.

10. MERGERS AND ACQUISITIONS ACTIVITY STEADY

Vigor merged with MHI Holdings earlier this year. Vigor photo

Over the years Vigor Industrial has grown with mergers and acquisitions of maritime facilities in the Northwest and Alaska and a customer list that includes private as well as major government clients such as the U.S. military and Washington State Ferries (WSF).

Vigor’s track record apparently made it attractive to global investor The Carlyle Group and private equity firm Stellex Capital Management which in September closed the purchase of the Portland, Ore.-based vessel fabrication and ship repair business and merged it with MHI Holdings LLC, a Norfolk, Va.-based ship repair and maintenance company. Terms were not disclosed.

The deal caps a year that also saw Kirby Corp. purchase the fleet of Cenac Marine Services LLC for approximately $244 million, and Canal Barge Company Inc. buy five towboats from Pine Bluff Sand and Gravel Co.

Carlyle will become majority owner of the new bicoastal company, and Jim Marcotuli, who was interim chairman and CEO of Remington Outdoor Company and CEO of North American Bus Industries, will be CEO. Stellex Capital, which owned MHI, will contribute new equity, and Vigor CEO Frank Foti will put in part of his majority ownership stake and join the new board as vice chairman. A spokesman for Vigor, which employs 2,300, said no layoffs were expected. MHI, whose clients include the Navy, Military Sealift Command and the Maritime Administration, employs 800.

Vigor’s government work includes a nearly $1 billion contract to build Army landing craft, a $254.5 million fixed-price contract to refurbish two Navy cruisers, and an extension of its contract with WSF — the largest ferry system in the U.S — to build up to five 144-car Olympic-class, hybrid-electric ferries.

Vigor has bulked up through the years with deals such as the purchase of Todd Shipyards Corp. in 2011 and Alaska Ship & Drydock in 2012, a merger with Oregon Iron Works, and acquisition of Seward Ship’s Drydock in 2014, and a merger with Kvichak Marine Industries in 2015. Expansion was helped by a $75 million private equity investment in late 2011.

But it was time for a series of investors who had been in the company to exit, said Foti, whose history with the company goes back to his purchase of Cascade General in 1995. “And we were growing, so we were looking for investors who could help us grow,” he said. “Private equity funds want the money back.” The search took about a year and a half. The median holding period is 4.5 years, down from 5.9 years in 2014, according to Bain & Company’s 2019 Global Private Equity Report.

“Vigor has a lot of growth for an old industry company,” Foti said, listing promising areas such as aerospace, ferry contracts and ship repair. Yards make about a 15% profit on repairs and 5%-7% on new construction, said a person familiar with the shipyard business. As for the future of the private side of the workboat market, Foti said, “We are in an interesting time in commercial boatbuilding.”

The Kirby deal completed earlier this year put the emphasis on youth.

The average age of Cenac’s barge fleet is four years, and its towboat/tug fleet is six years. The fleet consists of 63 30,000-bbl. inland tank barges with approximately 1.9 million bbls. of capacity, 34 inland towboats, and two 3,200-hp offshore tugs. Of the 63 barges, 48 are clean, 14 are black oil and one is oceangoing. Twenty-six of the towboats are 1,800-2,400 hp, five are 2,800-3,900 hp, and three of the towboats are Z-drives.

“Kirby was making a wise and diligent decision with a player that had relatively young assets that will serve them well,” said Brent Dibner, a maritime industry consultant and president of Dibner Maritime Associates, Chestnut Hill, Mass.

Cenac, Houma, La., is a natural extension of Kirby’s marine transportation segment, expanding its inland business and “lowering the average age of its inland tank barge and towboat fleet,” Kirby said in documents. Between 2009 and 2019, the average age of Kirby’s fleet dropped from 22.2 to 12.8 years.

Second quarter inland revenues increased 10% over the first quarter, primarily due to the Cenac acquisition and higher pricing. “We couldn’t be happier with the quality of people and assets we got there,” CEO David Grzebinski said in a conference call. “The assets are in really good shape, and we’ve been delighted.”

Cenac, which moved petrochemicals, refined products and black oil on the Lower Mississippi River, its tributaries and Gulf Intracoastal Waterway for major oil companies and refineries, was the latest in a steady stream of acquisitions for Kirby. On the marine transportation side, the Houston-based company has completed 37 acquisitions since 1986 to give it the largest inland and coastwise tank barge fleets in the U.S. — 1,067 inland tank barges and 309 towboats, and 49 coastal tank barges and 47 tugboats.

Cenac will focus on its shipyard, Main Iron Works, which earlier this year completed the first in a series of three Subchapter M-certified 2,680-hp towboats for Kirby. — Dale K. DuPont

9. AUTONOMOUS VESSEL GROWTH CONTINUES

The Navy's autonomous test vessel Sea Hunter undergoing tests in the Willamette River in Portland, Ore. DARPA photo

Autonomous vessel technology took a leap forward in 2019. Test vessels are being launched, partnerships are being formed, and the future has gotten closer to the present.

One of the most impressive test vessels this year was the Office of Naval Research’s 132' catamaran Sea Hunter that successfully navigated the Pacific Ocean between San Diego and Hawaii — and back again — with no human aboard. (Personnel from an escort vessel occasionally came aboard to test electrical and propulsion systems.)

Built by Vigor at its Portland, Ore., facility, the Sea Hunter was designed by Leidos, the Reston, Va., science and technology company that started as defense contractor SAIC in the 1960s. The vessel was conceived by the Defense Advanced Research Projects Agency (DARPA) as an unmanned vessel for mine sweeping and anti-submarine operations. Testing of the twin-screw Sea Hunter began in 2016 and was scheduled to continue through the end of 2019.

Designated as a medium displacement unmanned surface vessel (MDUSV), the Sea Hunter is designed to be capable of travel for long periods of time at speeds up to 27 knots and execute a variety of missions at a fraction of the cost for a manned ship. Not having to man the vessel is the greatest cost savings.

“The Sea Hunter program is leading the world in unmanned, fully autonomous naval ship design and production,” Gerry Fasano, president of Leidos Defense Group, said in early 2019. “The recent long-range mission is the first of its kind and demonstrates to the U.S. Navy that autonomy technology is ready to move from the developmental and experimental stages to advanced mission testing.”

In Stuart, Fla., SeaRobotics, Stuart, Fla., completed factory acceptance testing of its new entry into the autonomous surface vehicle (ASV) workboat market — the SR-Endurance 7.0 meter (22.96’) system.

The system is optimized for sonar research using an optionally manned helm configuration and a serial diesel electric propulsion system. Outfitted with an instrumented launch and recovery system (LARS), and supporting hydrographic winch system, the SR-Endurance 7.0 is capable of deploying towed sonar/instrument systems, dipping sonar/systems, or ROV systems.

“Having built numerous ASVs in the six-to 11-meter range, we are now offering a commercial workboat for the research and survey markets,” Geoff Douglass, SeaRobotics ASV development manager, said. “In many operational scenarios the advantages derived from a variable depth sensor such as a multibeam or side scan sonar, sub bottom profiler, or magnetometer, as well as the surface motion mitigation, make towed systems valuable in autonomous operations.”

The 80-hp SR-Endurance 7.0 sonar/sensor research platform has an endurance of up to six days at survey speed and up to 10 hours between automatic battery recharge. The multipurpose LARS and payload interface enable the integration of numerous user configured payload systems.

The optionally manned helm allows for crew operation in congested waterways and for ramp operations when required. With the flip of a switch, semi-autonomous operations, remote piloting and direct remote-control functionality is provided. Navigation is supported by a pre-programmed, or remotely operated pan/tilt/zoom video system, 360° video coverage with four situation awareness cameras, radar, AIS, low bandwidth Iridium, and a high bandwidth line of sight RF link.

In September, Boston-based autonomous marine technology developer Sea Machines and boatbuilder Metal Shark announced they were partnering in the construction and development of a new 29' Sharktech autonomous vessel.

The new Sharktech 29 Defiant welded aluminum monohull pilothouse vessel features original OEM-integrated Sea Machines technology offering a full range of advanced capabilities including active control and collision avoidance. The system allows for either traditionally manned, reduced-crew or unmanned autonomous operations. The Sharktech 29 Defiant is now available for acquisition by government and commercial operators under Metal Shark’s stock boat program.

Autonomous vessels are certainly of interest to naval officials who have been looking for ways to keep personnel safer during drug interdiction operations and in war zones. “This Sea Machines-Metal Shark autonomous surface vessel package was developed using the SM300,” said Don Black, Sea Machines’ vice president, sales and marketing. “This system is configured for over the horizon detection as it pertains to collision avoidance, using radar and AIS sensors.”

Black said the Sea Machines system can increase the productivity, predictability and safety of marine operations while helping to reduce incidents related to fatigue, poor visibility and challenging environments.

The Sea Machines technology suite is designed to integrate into a versatile, military-proven hull form. Nearly 400 Metal Shark 29 Defiant vessels are in service worldwide. Powered by twin outboard engines, the vessel achieves top speeds in excess of 45 knots. The Sharktech 29 Defiant may be customized to suit unique mission requirements. However, to reduce lead times, a standardized configuration has been developed for the stock boats program.

But the autonomous vessel is not just for military operations, according to Black. “Sea Machines and Metal Shark are well matched for municipality, county, or state agency operations, including patrol, security, environmental protection applications and more,” he said. — Ken Hocke

8. NAVIGATION FUNDING STRONG, BUT MORE NEEDED

Covered hopper barges on the inland waterways system. Corps of Engineers, Patrick Loch photo

Federal funding to shore up the nation’s deteriorating inland waterways system continued to make great strides over the past year, with record budgets for navigation construction, operation and maintenance, but billions more in predictable funding is still needed to create a modern system that is reliable for shippers and competitive in a global trade market.

Strong appropriations from Congress last fall meant that the Army Corps of Engineers, which oversees the inland waterways, was operating under a record $7 billion budget for civil works, 46% more than the administration’s request for fiscal year 2019. Meanwhile, the Corps’ Operations and Maintenance account rose to $3.74 billion, up nearly 25% over the administration’s request. It was the sixth straight year that lawmakers increased funding for the Corps, according to the Waterways Council Inc., an industry supported group that advocates for navigation funding.

Also included was a one-year change to the cost-share formula at the Chickamauga Lock on the Tennessee River to 85% federal funding and 15% from the Inland Waterways Trust Fund (IWTF), instead of a traditional 50-50 match. This has helped speed work on the Chickamauga project and also free up money to fund other navigation projects, WCI said.

Also waiting in the wings is the 2020 Water Resources Development Act (WRDA), which sets policies to modernize the inland system. Congress now seems to be on the positive path of authorizing this important law every two years instead of letting it lapse for multiple years, which had left several navigation projects in limbo.

But there are many uncertainties ahead. Impeachment proceedings could distract lawmakers and derail progress on waterways funding for fiscal year 2020. “Impeachment would absolutely take away the focus of legislators from their normal work and create a lot of partisanship, making it difficult to legislate,” Mike Toohey, WCI president and CEO, said in an interview.

Such delays could affect the fiscal 2020 budget for the Corps, which may increase Corps funding even more than the record 2019 number but is currently stalled in Congress. The fiscal 2020 year began Oct 1, but since lawmakers failed to approve a budget by then, departments are operating under a continuing resolution through Nov. 21. For the Corps, this means their budget will slide to $4.8 billion — the original administration request — until things are finalized.

“This creates very difficult management issues for the Corps. They must balance existing work with the funding available,” Toohey said. For the first quarter of the new fiscal year, there’s not much impact, he explained, but as a budget resolution gets stretched out, some projects will be at risk.

The House and Senate have different versions of the 2020 budget, with the Senate seeking an 85/15 cost-share change for another year for Chickamauga, while the House version would keep the 50-50 split for all projects. The Senate bill also has higher spending levels for the Corps civil works than the House bill, but the House has higher numbers for operation and maintenance.

In addition, Toohey said, if the cost-share stays at 50-50, work on ongoing projects will slow further as less money is available, prolonging completion dates and delaying starts of new projects. WCI continues to push for a permanent cost-share change to 75/25 to assure a more efficient and plentiful stream of funds for navigation work.

Another black cloud is the future of President Trump’s $1 trillion infrastructure initiative that he had proposed with much fanfare and enthusiasm early in his administration but has been so far unable to deliver.

“It’s gone into a deep sleep,” Toohey said of the plan. “But to the extent there’s an initiative, (waterways) expect to be included.”

Even at the current rate of record federal funding for navigation, the Corps still finds it difficult to maintain and upgrade inland locks and dams, many of which are 80 years old and are struggling to handle bulk shipping, according to a report by Informa Economics for the USDA released in August.

The report, “The Importance of Inland Waterways to U.S. Agriculture,” also said that multinational corporations, including Chinese companies, are making significant investments in grain and soybean transportation and handling systems in Brazil. U.S. farmers currently enjoy a cost advantage, but if U.S. infrastructure investment continues to lag, that advantage will erode, making U.S. grain and soybeans less competitive in global markets. — Pamela Glass

7. FERRY GROWTH CONTINUES

Eastern Shipbuilding launched the Michael H. Ollis for Staten Island Ferry on Nov. 15. Eastern Shipbuilding photo

NY Waterway operates 35 ferries, carrying 32,000 passengers daily on 23 routes connecting New Jersey communities to three Manhattan locations and upstate New York workers to commuter rail lines.

To meet growing demand, the company is building three 109'×32' 500-passenger ferries at Yank Marine in Tuckahoe, N.J. The first of these ferries, the Franklin D. Roosevelt, was expected to arrive in New York Harbor by the end or 2019.

This year has seen a building boom for ferries nationwide. New York, Washington, D.C., Washington state, San Francisco, New Orleans and other waterfront cities are adding new ferries and new routes.

In the New York Metro area, Seastreak, which operates high-speed catamarans from Atlantic Highlands, N.J., to Manhattan’s east side, runs eight boats for weekday commuter service and weekend excursions. The trip by water takes 45 minutes as opposed to more than 90 minutes by rail or car. Last year, the company added a new 150', 600-passenger ferry, the Commodore. It’s been such a success that Seastreak signed a contract with designer Incat Crowther for a nearly identical vessel. The new ferry will be built at Midship Marine, Harvey, La.

Ridership on NYC Ferry, which began service in 2017, has increased well beyond expectations. NYC Ferry now operates 27 vessels on six routes. The vessels, designed by Incat Crowther, were built at Horizon Shipbuilding, Metal Shark and St. Johns Shipbuilding.

In 2017, New York City signed a contract with Eastern Shipbuilding, Panama City, Fla., to build three new 320'×70'×21'6" Staten Island ferries. Production of the new vessels was delayed due to damage the shipyard suffered from Hurricane Michael in 2018, but construction is back on track. The first of the ferries, the SSG Michael H. Ollis, was launched in November and is slated for delivery in August 2020.

When Washington, D.C., shut down its Metro subway on some Virginia routes for three months this summer, many commuters looked to the water and took advantage of the Potomac Riverboat Company’s water-taxi service between Alexandria, Va., National Harbor, Md., and The Wharf in the District of Columbia.

The four 149-passenger, 88’ high-speed aluminum catamarans, designed by BMT and built by Metal Shark at its Franklin, La., yard went into service in 2018. “We got really busy, when the Metro shut down, and a lot of passengers stayed with us after train service came back after Labor Day,” Capt. Patrick Freeman told WorkBoat in October. A spokesperson for the water-taxi company, a division of Chicago-based Entertainment Cruises, said government officials authorized the commuter service to operate through the end of 2019, and negotiations were underway for it to continue after that.

On the West Coast, congestion on roads and freeways continues to get worse, and “ferries are uniquely suited to use the bay as a lane rather than a barrier,” said Thomas Hall, public information and marketing manager for San Francisco Bay Ferry/Water Emergency Transportation Authority (WETA). The ferry service, which has five regular routes, added three boats to the fleet in 2019 — two 445-passenger, 34-knot jet boats, built by Dakota Creek Industries Inc., Anacortes, Wash., and a 400-passenger 27-knot prop boat built by Vigor. Two more ferries are under construction. Ridership, Hall said, has increased 10% year over year and has doubled since 2012.

At Washington State Ferries (WSF), the focus is on clean energy. WSF has partnered with Vigor, to develop a hybrid-electric ferry program to produce five 144-car Olympic-class hybrids in its Seattle yard. Construction will begin in late 2020, with the first delivery expected in 2022. The new vessels, which will also have diesel engines, will be capable of running 100% on battery power once the dockside charging infrastructure is set up, WSF spokesman Ian Sterling said.

WSF is also planning to convert three of its largest Jumbo Mark II-class ferries to hybrid power. “It will be a race to see which gets done first, the new build or the conversion,” Sterling said. “But sometime in the next two to three years, people in Washington state will be able to ride on a ferry that is capable of running just on electricity.”

In New Orleans, two new 105', 150-passenger, high-speed aluminum catamaran ferries have been sitting at the dock, awaiting Coast Guard approval to carry passengers, since they were delivered by Metal Shark in 2018.

The Coast Guard noticed several problems during a July inspection, including inadequate crew training and performance, according to Capt. Kristi Luttrell, the officer in charge of making inspections.

The upshot is that the city is seeking a new operator to replace Transdev North America, which has been in charge of operations since 2009. The city plans to select a new operator in December with the contract beginning on Feb. 1, 2020. — Betsy Frawley Haggerty

6. OFFSHORE DOWNTURN CONTINUES

Jackson Offshore's 4,357-dwt OSV Breeze. Jackson Offshore photo

The U.S. Gulf of Mexico oil and gas industry is still in the depressed activity mode.

In 2018, a recovery in oil prices looked promising, but the price for West Texas Intermediate (WTI) has fell from $75 bbl. in the fourth quarter to around $56 bbl. in early November. This has dampened chances for a strong recovery and is a big reason that depressed activity levels continue in the U.S. Gulf.

The weak oil prices have been driven by international production issues and the continuing explosion of shale oil production in the U.S., particularly in the Permian Basin and New Mexico.

According to a report by analysts Wood Mackenzie, drilling was expected to increase in 2019. But while the market and rig count may have improved slightly, it was not a strong year.

But there is hope. A key factor to ensuring future growth will be holding on to the industrywide efficiency gains made since 2014, the WoodMac report said.

“In the last four years, deepwater operators have focused heavily on lean operations, standardization and industry collaboration to achieve fiscal discipline,” said WoodMac’s William Turner. “Reverting to inefficient ways of doing things is a real threat that operators need to look out for in 2019. The challenge to operators and the service sector alike will be to hold onto lessons learned, mitigate efficiency risks where possible and properly plan for higher costs and longer schedules where unavoidable.”

IHS Markit senior marine analyst Richard Sanchez said in May that the more optimistic market watchers projected that the industry would add one to two rigs this year, but that oil prices do not appear to be strong enough to draw additional activity. That’s about what has occurred, with three rigs through Oct. 31, according to the Baker-Hughes rig count. “The workboat industry is not very exciting now,” he said in May.

Jackson Offshore Operators’ vice president and chief operating officer Matt Rigdon said earlier this year that he was looking at three or four years before business returns to normal levels. “In deepwater, the market has been flat since mid-2018, at approximately 20 vessels,” he said. “In my opinion, any significant increase in vessels numbers is unlikely this year. Perhaps we will add one vessel but there won’t be a boom. We don’t think the market will return to normalcy until 2022, 2023.

“Probably the biggest concern with regard to the timing of this prediction is what levels of production will we see from onshore unconventional production in the next few years,” Rigdon said.

The possibility of major mandatory drydockings continues to contribute to the depressed outlook. With large numbers of long-term stacked vessels and active vessels seeking drydock extensions, a potential drydocking crisis looms.

“With regard to mandatory upcoming drydockings in the $1 million to $2 million range, owners are looking at current day rates and it doesn’t make sense,” said Sanchez. “Those with big fleets can, and do, withdraw boats with pending drydockings from the market and replace them with other vessels.”

Rigdon agreed. “Over half of the deepwater vessels now in operation were delivered in the 2014-2015 time frame. They are now due for the mandatory five-year special survey.”

But Rigdon said this situation should eventually pay off. That’s because a drop in the availability of OSVs due to drydocking will put supply and demand close to equilibrium. “The second factor in favor of day rates is that the spot market for vessels is, more or less, vanished.”

Still, the near-term outlook for day rates is gloomy. “The U.S. Gulf has taken a turn for the worse,” Sanchez said in late October. “My forecast says 2020 activity will decline further, out to 2021.”

In his Oct. 31 earnings call, Todd Hornbeck, CEO of Hornbeck Offshore Services, said the company’s third-quarter results were disappointing, with market demand for its offshore service vessels soft, mainly in the U.S. Gulf of Mexico.

“We had expected that in the third quarter the positive sentiment that we had observed previously would have translated into improved utilization and day rates. While we are still seeing signs of improving demand fundamentals ... and believe that there are positive indicators for future improvement, we simply have not seen them turn into improved financial performance yet.”

Hornbeck said that there continues to be vessel operators in the Gulf that value market share more than improved long-term sustainable rates.

“The challenge is that we are playing a game that does not have a shot clock, and so we are unable to predict with any certainty when the long-term opportunities will reach us or the short-term thinking will catch up with them.” — David Krapf and Bill Pike

5. TARIFFS HIT BOATBUILDERS

President Donald Trump put tariffs on Chinese steel and aluminum and China retaliated with a 25% tariff on soybeans exports that hurt some in the barge industry. iStock photo

President Trump’s tariffs on imported Chinese steel and aluminum and China’s retaliatory 25% tariff on U.S. soybean exports continues to impact the U.S. maritime sector, especially boatbuilders and barge operators that haul soybeans down the Mississippi River to New Orleans for export.

Once the tariffs went into effect on March 8, 2018, prices did go up on steel and aluminum for boatbuilders. In Panama City, Fla., Rudy Sistrunk, president of Marine Inland Fabricators (MIF), first felt the price jump that month and, he said, “steel went crazy. Within a 12-month span it went up 30%.” He was “adjusting boat prices probably every two weeks for a long time.” Since then prices have settled down and may have even gone down a bit, he said.

The lucky builders were those that had steel or aluminum plate on hand before tariffs were enacted. “In the beginning we didn’t get hit too hard,” said Bob Pelletier, vice president of Blount Boats, Warren, R.I., because most of the steel and aluminum plating that was needed for the next job was in stock.

When that was used up, Blount did see the effect from tariffs. Like other boatbuilders, it was not just on plating but on “small things — doors, windows and bench seats — where there’s more price increase because of the tariff,” said Pelletier.

Even when a builder was given a certain quote, several months later vendors would come back to Pelletier and say that they had to increase the price because they got hit with tariffs. Those incremental increases are hard to plan for and can be tough to overcome. “That’s where your profit goes to picking up the constant increases. Cross your fingers and hope you have enough margin to absorb that,” said Pelletier.

Rozema Boat Works in Mount Vernon, Wash., came close to being ensnarled in a tariff dispute from another direction when President Trump imposed 25% steel and 10% aluminum tariffs on Canada. Rozema Boat Works builds boats for Canadian customers and was in the middle of a large boatbuilding contract when the “tariff war happened,” said Dirk Rozema, president of the boatyard. Canada’s reaction was to almost double taxes on imported boats, he said. Rozema’s fear was that the customer would have to pay the additional duties, affecting future boat sales. But the boat was released without additional duties “when the Canadians and the U.S. settled their issue,” which would have been May 2019.

Beyond that, Rozema Boat Works was another boatbuilder that missed the early tariff price impact on imported metals. “When a lot of that happened, we may have been in a run where we had most of our material,” said Rozema. He remembers that the price of aluminum “went up big time,” but when it was time to order aluminum for the next boat “it had settled towards normal levels.”

Rozema is seeing spikes in certain products. An example is a raw-water stainless steel sea strainer that went up 30% from its quoted price. He said he doesn’t “know how much is tariffs and (how much is domestic) people raising their prices.”

Some domestic producers of steel and aluminum aren’t oblivious to the chance to get in on the upward pricing trend.

Gladding-Hearn Shipbuilding in Somerset, Mass., builds mostly aluminum boats. Peter Duclos, Gladding-Hearn’s president, said the tariffs definitely have had an effect. “There’s upward pricing pressure across the board for every part that has aluminum,” he said. He figures that it is, in part, “opportunistic pricing where domestic aluminum sellers may see an opportunity to raise prices a little.”

Are tariff generated price increases affecting new boat sales? For Duclos, “even if it adds 10% to aluminum in the boat, it’s not a deal breaker. It’s just one piece of everything other thing that has an impact.”

Sistrunk of MIF mostly builds truckable pushboats and doesn’t feel the tariff-induced prices will affect his business. “They are not going to stop building these little boats. They are too economical.”

Rozema said that tariffs “haven’t had a dramatic effect,” but admitted he’s not sure how they will affect future sales. “Prices have been creeping up on materials,” he said, and the tariffs “make the environment uncertain.”

Boatbuilders aren’t the only ones being hit by tariffs. So, too, are barge companies that move grain. U.S. soybean exports, most of which had gone to China in the past, still faces uncertainty.

That’s despite a recent “uptick in sales to China as of late,” said Mike Steenhoek, executive director of the Soy Transportation Coalition in Ankeny, Iowa. “But overall until this issue (tariff dispute with China) is solved it’s hard to be optimistic about our export program.”

From 2017 to 2018 27.7 million metric tons of soybeans were exported to China, said Steenhoek. In 2018 through 2019 (the marketing year ended Aug. 30), 13 million metric tons went to China. USDA figures for this past July showed the number of grain barges unloaded at Mississippi River export elevators were 19% below the three-year average.

Much of the almost 15 million metric ton reduction is due to tariffs, but China has also cut back on soybean imports because of African swine fever, which has been decimating its hog herds, and soybean meal is a main ingredient for pork production. Pork is also the most popular meat in China, said Steenhoek, so even if there wasn’t a trade war with China, the “total (export) volume would be less, but we would still be exporting. But over the past year we haven’t because of the trade standoff.”

The lack of predictability makes it “difficult for a barge company trying to stage really expensive equipment and where does it need to be at a particular time. Being able to plan ahead is really difficult,” Steenhoek said. — Michael Crowley

4. OFFSHORE WIND MOVES FORWARD

The U.S. market is preparing for more offshore wind. Deepwater Wind photo

The U.S. offshore wind energy industry is poised for its first utility-scale projects in federal waters off Northeast and Mid-Atlantic states — a region that one official with wind developer Ørsted calls “the Saudi Arabia of offshore wind.”

But the commercial fishing industry’s skepticism — and other maritime industry concerns about safety and navigation — prompted the federal Bureau of Ocean Energy Management to reconsider.

The process toward reviewing and ultimately permitting a dozen or more East Coast wind turbine projects continues to move forward, with construction planned in earnest by the early 2020s.

BOEM’s August decision to revisit the potential cumulative impacts of so many projects was triggered after the National Marine Fisheries Service refused to sign off on an environmental impact study of the 800-megawatt Vineyard Wind project off Massachusetts, where commercial fishing groups complained the government was moving too fast to approve projects without adequate safeguards for fishing vessel safety and environmental impacts.

That initially raised alarms among environmental activists that the Trump administration might be moving to block offshore wind after all, while still promoting oil and gas development.

But perhaps just as significantly, offshore operators in the Gulf of Mexico energy industry had meanwhile committed to supporting the East Coast wind industry. In June the Offshore Marine Service Association, based in New Orleans and a 46-year advocate for offshore oil and gas, formed the OMSA Wind Committee.

The association is talking up the opportunities for offshore operators in wind — a big step in the oil patch world, long skeptical of claims by renewable energy advocates.

“The U.S. maritime industry has met the needs of every market it has encountered, and I’m confident that the offshore wind market will be no different,” OMSA chairman and president of Aries Marine, Court Ramsay, said when the association announced its decision. “I know my company has already committed vessels, resources, and personnel to offshore wind, and I look forward to working with fellow OMSA members on the OMSA Wind Committee to promote this market.”

OMSA officials defined the committee’s mission as recommending “strategies and initiatives that increase U.S. maritime industry involvement in the offshore wind sector,” and working to ensure that developing laws and regulations governing the new industry benefit vessel operators and mariners.

The group said it also aims to “ensure U.S. offshore wind infrastructure is constructed, serviced, and maintained in a Jones Act compliant manner.”

By the end of September, wind developers at a State University of New York Maritime College symposium were expressing optimism that BOEM is continuing its review process for individual projects. New York, New Jersey and Massachusetts energy planners and political leaders forged ahead on contracts and power agreements.

That has more naval architects, shipyards and others lining up to follow the lead of Blount Boats in Warren, R.I., which delivered the first U.S.-flag crew transfer vessel (CTV) for the Block Island Wind Farm in 2016. The New York-based Reinauer Group through its affiliate WindServe Marine LLC is building on its experience with that modest five-turbine, 30-MW project to build two more CTVs for operator Ørsted in preparation for its utility-scale projects off southern New England and New Jersey.

CTVs are high-speed catamarans that deliver technicians and smaller equipment, key to both the first stages of construction and ongoing maintenance of wind turbine arrays in Europe. European wind developers have long seen the Jones Act as a potential drag on developing the U.S. market, unless U.S. shipbuilders see incentive to build the much bigger vessels needed for construction.

There is not a Jones Act-compliant wind turbine installation vessel (WTIV) yet, and the prospect of hiring those from Europe – and supplying them on the construction sites by barge from U.S. ports to comply with the Jones Act – could be problematical on several levels. With big new wind projects planned in Europe and Asia, the availability of existing installation vessels is likely to be limited and command high day rates.

Wind energy advocates say the U.S. demand will create its own domestic solution as more projects are lined up, using European experience and U.S. design and shipbuilding talent.

At the American Wind Energy Association’s October offshore wind power conference in Boston, Germany-based Bernhard Schulte Offshore GmbH and partner MidOcean Wind LLC announced they established a Connecticut-based joint venture “to build and operate support vessels for the U.S. offshore wind industry as well as explore opportunities in other sectors of U.S. merchant shipping.”

European operators are encouraged by how the legacy U.S. offshore companies now see wind energy, Equinor Wind US wind president Christer af Geijerstam said at the Boston event: “From what I have seen from attending conferences, the Gulf of Mexico supply chain is rallying towards to offshore wind.”

That confidence attracted more entrants like the EnBW Group, a German utility company and offshore wind developer preparing to bid on an anticipated 2020 round of federal energy leases in the New York Bight. New York state in mid-October finalized contracts with Equinor for its 816-MW Empire Wind project near the New York Harbor approaches, and the Sunrise Wind 880-MW project that Ørsted and Eversource Energy plan for a federal lease east of Long Island.

Along with obtaining U.S.-built vessels and supply chains, wind developers are acutely aware of future workforce needs.

Maritime colleges are positioning to train their students for those future opportunities. In October the Massachusetts Maritime Academy laid claim to the first U.S. offshore wind training program — a six-day course of five training modules, based on standards of the Global Wind Organization. SUNY Maritime is likewise working on an offshore wind curriculum that could be ready for 2020. — Kirk Moore

3. SUBCHAPTER M COMPLIANCE MOVES AHEAD

FMT opted to use a third party organization to get the new towboat in compliance to receive its COI at delivery in accordance with Subchapter M regulations. Steiner Shipyard photo

The first chapter of Subchapter M has been completed and the story is unfolding. A sweeping set of regulations meant to raise the bar for safety across the workboat industry, Subchapter M, has now been in effect for 18 months.

The regulations, 15 years in the making, affects all towing vessels larger than 26'. The Coast Guard now requires these vessels to maintain a Certificate of Inspection, which indicates compliance with a broad set of regulations covering everything from electrical systems to health and safety plans. The requirements are both structural and administrative. Thus far, implementation and compliance appear to be on track but concerns about consistency and enforcement remain.

The Coast Guard partnered with industry from the start recognizing that the agency’s resources would never be up to inspecting some 5,800 towing vessels. The American Waterways Operators (AWO) had already created the Responsible Carrier Program, an internal auditing and review system used by AWO member companies. This became a foundational document for the drafting of Subchapter M.

The result of this partnership is a cottage industry of designated third party organizations (TPOs) that have taken on the role of monitor to towing vessel operators. There are currently 10 of these organizations that work with their customers to develop and implement a towing safety management system (TSMS), and conduct audits and surveys of the vessels’ operations and machinery. The company then reports to the TPO rather than directly to the Coast Guard.

Recognizing that the expense of hiring a TPO might be difficult for smaller outfits, the Coast Guard also offers the option to ask the local Officer in Charge, Marine Inspection (OCMI) to perform the vessel and documentation inspections. Approximately 75% of companies have chosen the TSMS option, which was what the framers of the regulation anticipated.

“The TSMS option needs to be incentivized,” AWO president and CEO Thomas Allegretti told a recent conference on Subchapter M. “The TSMS is a living process, something to evaluate every day.”

He said that such self-evaluation builds a “culture of safety and not a culture of compliance.”

The regulations associated with Subchapter M went into effect July 2018, with a phased-in process for the issuance of COIs. Twenty-five percent of any towing vessel fleet is now required to carry a certificate. According to the Coast Guard, some 1,150 COIs have been issued to date. There are some 350 in line which puts the process on track to meet its goal, since single vessel operators have until next year to get their COI. The phase-in continues until all tugs and pushboats are certified in 2022.

Efforts to reach all affected vessel operators have been comprehensive. The Coast Guard’s Towing Vessel National Center of Expertise (TVNCOE) created a website designed to walk operators through the compliance process. Operators can enter their vessel particulars and operation areas and learn exactly what kind of equipment and documentation will be required for a COI. The TVNCOE also has organized industry events in several regions. Most recently, the Maritime Institute for Technology and Graduate Studies (MITAGS) hosted a conference in Baltimore devoted to Subchapter M. Attendees were encouraged to network with members of the team that created the regulations and heard presentations from them.

Concerns linger about consistency in the COI process and enforcement of the regulations. Pat Folan was a member of the Towing Safety Advisory Committee that worked with the Coast Guard in the earliest phases of the rulemaking. Today he is a consultant for operators as they navigate the COI process. His company, Tug and Barge Solutions, Daphne, Ala., performs inspections and makes recommendations.

“We had many discussions in TSAC around the need for consistency,” Folan said. “It was a concern from the beginning, considering that these vessels are so diverse themselves, and these are people doing the inspections.”

He sees that the concerns were warranted. “I have now attended many inspections. I have seen an entire Subchapter M inspection conducted without a checklist of any kind. I have seen equipment allowed in one sector be rejected twenty miles away in the next sector.”

Another area of concern for the industry is enforcement. Operators who are spending thousands of dollars to comply with Subchapter M are not seeing consequences for the companies that have scoffed the law. “Enforcement must be enforceable,” said Erik Johnson, national towing vessel coordinator for the Coast Guard Office of Commercial Vessel Compliance. He said that the phase-in period has made enforcement difficult but there are several enforcement policies that will be coming soon to a Coast Guard sector near you.

Johnson points to the busiest towing vessel sector in the country, District 8, which is based in New Orleans. There were 655 deficiencies reported there between July and September of 2019 with nine vessels detained. The top three deficiencies were found in main engine propulsion and other machinery, and structural conditions, not in the small stuff. “We are not going out and targeting, but we are using risk-based trends we see within a company,” said Johnson.

Pandora’s box may spring open for even the most compliant operators with the first internal structural exams. “When it comes time for drydocking, there are going to be some ugly surprises in store for owners of older vessels,” said Folan.

As the questions arise, appeals are made and COIs issued, the big picture is that the “Coast Guard mostly got it right,” Allegretti told MITAGS conference attendees. Before Subchapter M, he said, some 25 to 30 mariners lost their lives every year. Today that number is three to four. “If we achieve nothing else, those people’s lives are worth it.” — Kathy Bergren Smith

2. DIVE BOAT FIRE MAY LEAD TO NEW REGS

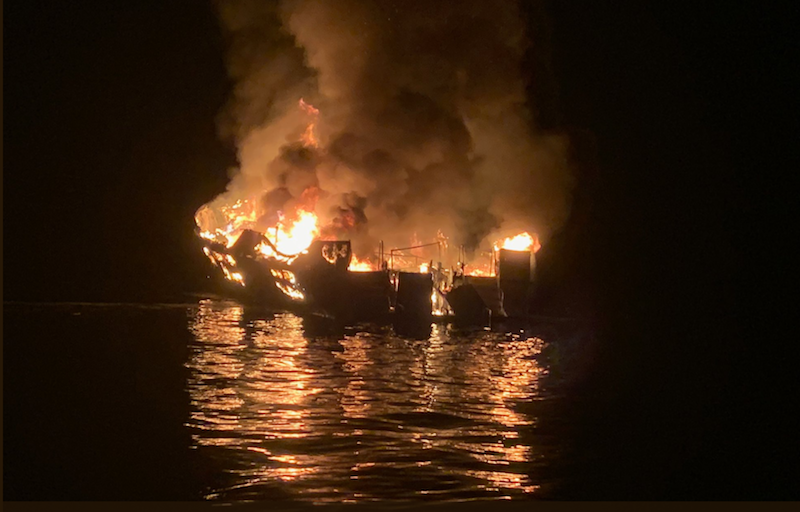

Thirty-four passengers and crew died in the dive vessel Conception fire. Santa Barbara County Sheriff's Office photo

Federal officials are trying to determine the cause of a California dive boat fire that killed 33 passengers and one crew while overnight vessel operators brace for intensified inspections and possible new regulations.

A number of agencies are looking into the Sept. 2 tragedy, including the Coast Guard, FBI, and the Bureau of Alcohol, Tobacco and Firearms (ATF) in consultation with the U.S. attorney which searched the offices of boat owner Truth Aquatics and its two other vessels. The Coast Guard also has convened a rare Marine Board of Investigation — the second in two years after a similar disaster probe begun last year over a duck boat sinking that killed 17 people near Branson, Mo. The investigations could take more than a year to complete.

All six crewmembers were asleep when the fire started on the 75'×25' wooden hulled dive boat Conception off Santa Cruz Island, the National Transportation Safety Board (NTSB) said in a preliminary report. The Certificate of Inspection (COI) for the vessel built in 1981 requires a roving watch, according to the Coast Guard, which said the vessel complied with regulatory requirements. The victims likely died of smoke inhalation, officials said.

A Coast Guard safety bulletin issued right after the fire urged operators to make sure their vessels are safe. One major suggestion was to limit the unsupervised charging of lithium-ion batteries and extensive use of power strips and extension cords. The NTSB said a lot of cameras, cell phones and other equipment were being charged onboard the Conception.

An NTSB official describing the harrowing moments before the fire erupted said one crewmember reported he awoke to noise and saw flames coming from the galley. He tried to get down a ladder, but it was already burning. The crew on the bridge jumped down to the main deck and tried to get through the galley’s double doors to the passengers, but it was in flames. When they couldn’t get through some windows, they jumped from the boat.

Capt. Sean Tortora suggests more firefighting training be required for the entire crew on vessels less than 100 tons. The only person who needs credentials now is the captain; others learn on the job, said Tortora, a master mariner and president of the New York-based marine consulting firm Long Island Maritime LLC. He’s also the author of “Study Guide for Marine Fire Prevention, Firefighting & Fire Safety.”

Regulations don’t require a dedicated firefighting course for captains, he points out. Engine rooms must have fixed fire extinguishing systems. Elsewhere, the vessel must have one portable extinguisher for every 2,500 sq. ft., and one each in the wheelhouse, galley and machinery space as well as smoke detectors.

As for a timetable for any new firefighting regulations, Tortora points to the 20 years it took for Subchapter M with its stringent towboat training drills to become reality. “It’s a slow process,” he said. “I’m all for more requirements. The industry will tell you this is a freak accident. It’s going to take a lot of public pressure.”

The Passenger Vessel Association (PVA) has advised members to review risk management procedures because the accident may prompt a Coast Guard crackdown on overnight vessels. “It is likely that the Coast Guard will intensify inspection efforts for passenger vessels with overnight accommodations; focusing specifically on fire safety, vessel operations and safety management,” the trade group said.

Three days after the accident Conception’s owner, Truth Aquatics, of Santa Barbara, sought to limit its liability under an 1851 act that keeps damages to the value of the vessel and its freight.

“They’re basically saying they don’t owe any of the victims anything,” said Robert Mongeluzzi, a Philadelphia lawyer who represents victims of the Missouri duck boat accident and represented victims in an earlier duck boat fatality in 2010 on the Delaware River. Operators in both of those cases also sought protection under the act. The Philadelphia case was settled two days into a trial.

Limitation requests can be defeated by either proving the vessel was unseaworthy in areas such as egress and fire safety or proving negligence before the vessel left which would cover training manuals, he said.

Truth Aquatics has suspended all operations indefinitely, saying on its website that it will “dedicate our entire efforts to make our boats models of new regulations” working with the NTSB and the Coast Guard.

A surviving crewmember has sued, claiming the vessel was unseaworthy. A lawyer for the owner said the claims “are inconsistent with the years of successful annual U.S. Coast Guard inspection reports, including one in February of 2019.”

Meanwhile, at least one dive boat operator citing the tragedy is no longer allowing overnight stays before boarding for early morning trips. — Dale K. DuPont

1. FLOODS, HIGH WATER AFFECT BARGING

Water flows uncontrolled around a sunken barge at Webbers Falls Lock & Dam 16 near Webbers Falls Okla., on Aug. 20, 2019. Two barges slammed into the lock and dam on the McClellan-Kerr Arkansas Rive Navigation System during a near record flood event in May 2019. U.S. Army photo by Preston L. Chasteen

Water levels on the U.S. inland waterways system are extremely important to the efficient movement of cargo by barge. While it’s rare that water level problems don’t occur somewhere on the system sometime during the year, 2019 saw high water levels reach the extreme.

High water conditions present numerous risks for towing vessels, including unusually strong river currents and dynamic eddies. River currents are often different from one section of the waterway to another. Consequently, the Coast Guard said it was absolutely essential that vessel operators provide a wide berth when maneuvering around any other vessel or object. For reference, when a river current is flowing at one knot, the water is moving at 1.7 feet per second, or approximately 100 feet per minute. This means that in a six-knot current, the water is moving about the length of a football field in just 30 seconds. Additionally, the faster the current, the greater the forces acting on a vessel when it’s pinned against a stationery object.

When talking about the movement of water along the Mississippi River and its tributaries, all roads lead to New Orleans and eventually drain into the Gulf of Mexico.

In August, the Corps of Engineers made it official when after 292 days, the agency was finally able to end its flood fight efforts. The historic and unprecedented high-water event began and surpassed the 1973 high water event, 225 days, as the longest in the Corps New Orleans District’s history. This year also marked the first time the Mississippi River’s Bonnet Carré Spillway was put in operation in back-to-back years, twice in one year, as well as the longest single opening at 79 days and a combined 123 days in 2019.

The Bonnet Carré is located 28 miles above New Orleans, part of the multistate Mississippi River and Tributaries (MR&T) system, which uses a variety of features to provide flood risk reduction to the alluvial Mississippi Valley from Cape Girardeau, Mo., to Head of Passes, La. It can divert a portion of the river’s floodwaters through Lake Pontchartrain into the Gulf of Mexico, allowing high water to bypass New Orleans and other nearby river communities. The structure has a design capacity of 250,000 cfs, the equivalent of roughly 1.87 million gals. per second.

Throughout the fight, the Corps worked closely with federal, state, and local partners to coordinate efforts and conduct inspections of the entire river levee system to ensure it would perform as designed and safely pass the high water.

“In my 45 years in this industry, this is the longest period of sustained high water that we’ve experienced,” Walter E. Blessey Jr., chairman and CEO of Blessey Marine Services Inc., a large inland tank barge operator based in Harahan, La. (New Orleans), told WorkBoat during the summer. “We have also had to deal with unprecedented river velocities. For the first time ever, I have been told by our vessel captains that they are experiencing anxiety when operating on the Mississippi, Ohio and Illinois rivers. The floodwaters from the Missouri River and Arkansas River systems are putting a strain on our industry.”

The high water conditions created commerce disruptions, temporary shutdowns of sections of the system, idled equipment and revenue losses. Some vessels were idled for weeks and even months.

The prolonged opening of the Bonnet Carré caused problems outside the marine industry too. The fresh water from the river system mixed with the brackish water in surrounding lakes and the Gulf’s salt content to create an algae that forced the closer of beaches and popular recreational boating spots for most of the summer. Businesses lost plenty of revenue over the Fourth of July holiday alone.

Thomas Allegretti, president and CEO of the American Waterways Operators, said there were times during the fight when industry workers hadn’t been paid and farmers couldn’t plant their crops.

Barge operators are used to dealing with weather events — adjusting their operations to floods, drought, high water, swift currents, blinding rain, thick ice and snow. Since the beginning of barging in the U.S., this has always been a part of the inland business. But this year, many barge lines have had to take extraordinary steps to avoid damage to their fleets and injuries to crews, keep their cargoes protected, and meet customer-driven delivery schedules.

“The duration of high water on the Lower Mississippi River and in the Gulf fleets and terminals (which began in mid-December 2018) has had the most significant impact to us, making local Gulf deliveries very difficult,” Mark Knoy, president and CEO of American Commercial Barge Line, said in an interview earlier this year. He added that “tow size reductions and daylight running restrictions at some bridges between St. Louis and the Gulf have really hurt production and run up costs. Our 40-barge boats have been limited to 25, which is 60 percent capacity, for six months now.”

ACBL added more than 20 boats to help combat the bad conditions. In the Gulf, it deployed larger horsepower boats, doubling the Gulf boat fleet, to assure product delivery.

He estimated losses to the barge industry to be in the couple of hundred million range, based on what ACBL has experienced. — Ken Hocke