The second day of the California wind energy auction closed at $757.1 million, double the first day’s per-acre average. The Department of Interior hailed the first Pacific auction as “well exceeding the first lease sales that were held in the Atlantic.”

“Today’s lease sale is further proof that industry momentum – including for floating offshore wind development – is undeniable,” said Interior Secretary Deb Haaland in announcing the results.

At an average $2,028 per acre, the California prices don’t approach the $4.37 billion bid for 488,000 acres in the New York Bight in February 2022. That differential was widely anticipated in the industry, considering the time frame and expense that will be required to develop plans for deploying floating wind turbines in deep Pacific waters.

But the auction is still a positive sign for the Biden administration’s hope to develop 15 gigawatts of offshore wind capacity by 2035.

“This auction commits substantial investment to support economic growth from floating offshore wind energy development – including the jobs that come with it,” said BOEM Director Amanda Lefton. “These credits and additional lease stipulations demonstrate BOEM’s commitment to responsibly grow the offshore wind industry to achieve our offshore wind goals.”

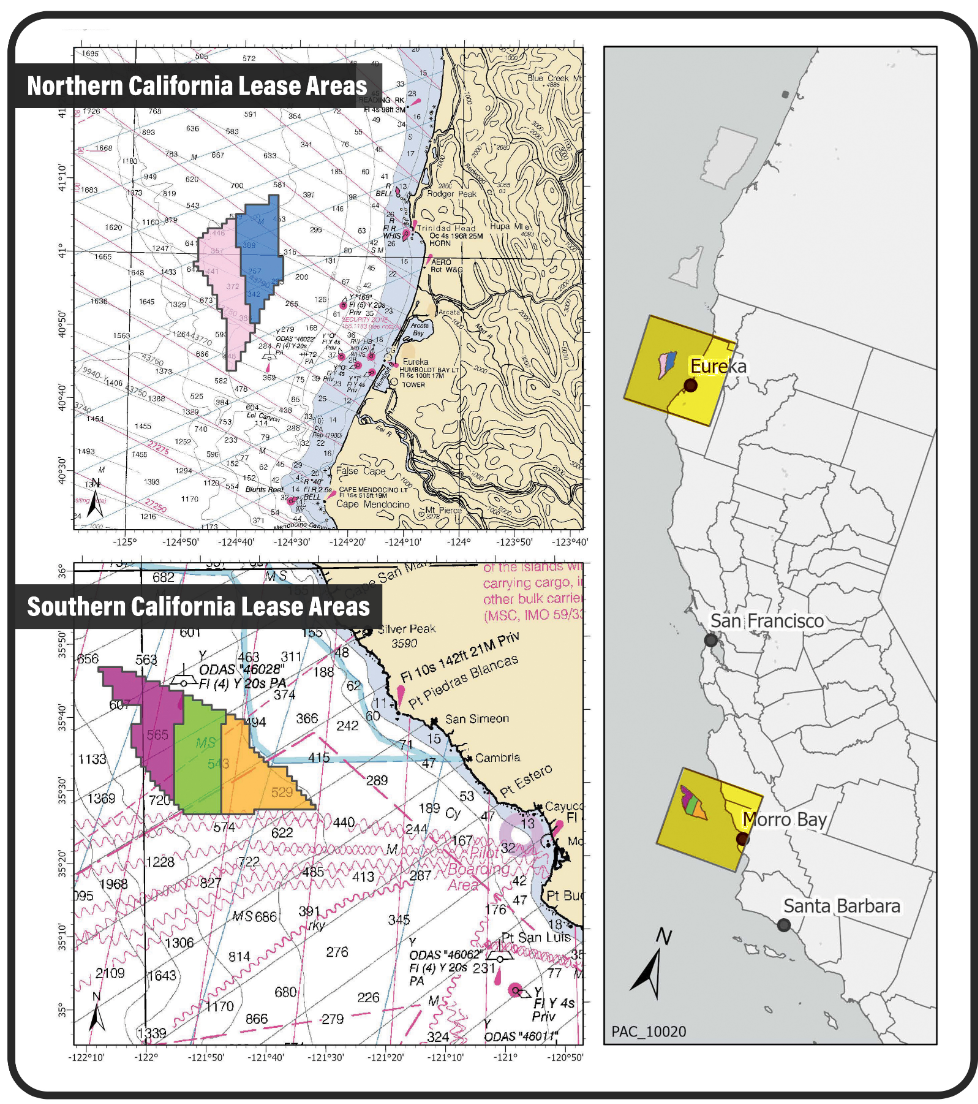

BOEM offered five lease areas covering 373,268 total acres – three off central California near Morro Bay and two in the Humboldt region off northern California.

The provisional winners:

- RWE Offshore Wind Holdings, LLC, $157.7 million for 63,338 acres in lease area OCS-P 0561.

- California North Floating, LLC, $173.8 million for 69,031 acres in OCS-P 0562.

- Equinor Wind US, LLC, $130 million for 80,062 acres in OCS-P 0563.

- Central California Offshore Wind, LLC, $150.3 million for 80,418 acres in OCS-P 0564.

- Invenergy California Offshore LLC, $145.3 million for 80,418 acres in OCS-P 0565.

The lease sale included a 20 percent credit for bidders committed “to a monetary contribution to programs or initiatives that support workforce training programs for the floating offshore wind industry, the development of a U.S. domestic supply chain for the floating offshore wind energy industry, or both,” according to the Department of Interior. “This credit will result in over $117 million in investments for these critical programs or initiatives.”

Bidders got a 5 percent credit for committing to community benefit agreements to benefit communities and stakeholder groups such as fishermen “whose use of the lease areas or use of the resources harvested from the lease areas is expected to be impacted by offshore wind development,” according to the department.

Stipulations in the leases require developers to engage with other ocean users, communities and California tribes that may be affected by their projects.

“These lease stipulations are intended to promote offshore wind energy development in a way that coexists with other ocean uses, addresses potential impacts and benefits, and protects the ocean environment, while also facilitating our nation’s energy future for generations to come,” according to the department.

Wind developer Equinor expects its Morro Bay lease could be developed for 2 gigawatts capacity. The company already has 3.3 GW in projects in the pipeline off the U.S. East Coast.

“The US West Coast is one of the most attractive growth regions for floating offshore wind in the world due to its favorable wind conditions and proximity to markets that need reliable, clean energy,” said Molly Morris, president of Equinor Wind US.

“We were among the first movers into U.S. offshore wind and are now one of the first movers into California, a market we believe will become a strategic floating market globally. We now have the scale needed to optimize value across our US and Asia-Pacific portfolio,” said Pål Eitrheim, executive vice president of Renewables in Equinor.

Wind power advocates say the California leases can spur a new phase in the still-developing U.S. industry.

“The future is floating…by tapping into the vast wind resources along our country’s Pacific Coast, we can cement the United States as a global leader in floating offshore wind technology and supercharge our deployment of clean, affordable, and reliable wind power,” said Liz Burdock, president and CEO of the non-profit Business Network for Offshore Wind. “While these lease sales mark an important moment for floating offshore wind in U.S. waters, industry and our public stakeholders must quickly build a strong domestic supply chain to support the new industry and advance the port and transmission infrastructure necessary to ensure market readiness.”

"California, and the U.S. as a whole, have a remarkable opportunity to establish global leadership by going big on floating offshore wind. BOEM’s initial lease auction for the Morro Bay and Humboldt Wind Energy Areas is an important step to making that a reality,” said Adam Stern, the executive director of Offshore Wind California, a trade group of offshore wind developers and technology companies.

“Looking ahead, we need to focus on the essential next steps to bring California offshore wind online, which include investments in transmission and port infrastructure, a clear roadmap on permitting, procurement, a robust supply chain, workforce training, and more call areas to reach the state’s 25 GW goal,” said Stern.