Will 2024 prove as monumental a year for the offshore wind industry as last year? Reading the respective press releases and news stories brought to mind the opening line of Charles Dickens’ A Tale of Two Cities: “It was the best of times, it was the worst of times.” That describes the East Coast offshore wind industry today.

The best of times. Avangrid Inc., a member of the Iberdrola Group, and Copenhagen Infrastructure Partners CI II fund are jointly developing Vineyard Wind 1, an 806-megawatt project located 15 miles off the coast of Martha’s Vineyard. According to a Jan. 3 press release, the first turbine undergoing commissioning sent five megawatts of power to the New England grid at 11:52 PM the night before. Is it still sending power? Our inquiry to Avangrid has not been answered, but the press release talked about further testing being needed. Sounds like it isn’t sending power.

The press release claims this power is the first to come from a commercial-scale U.S. offshore wind project. However, Ørsted and partner Eversource claimed they sent the first power from their South Fork Wind farm off Long Island to the New York grid in early December. Funny, we haven’t heard anything more from them. But how could Avangrid have missed that announcement? Maybe there is a back story we don’t know yet.

Block Island Wind in Rhode Island waters holds the title of the nation’s first operating offshore wind, having begun operations in late 2016. The five-turbine, 30-MW Block Island Wind and the two-turbine, 12-MW Coastal Virginia Offshore Wind projects, while operating, are not considered commercial projects.

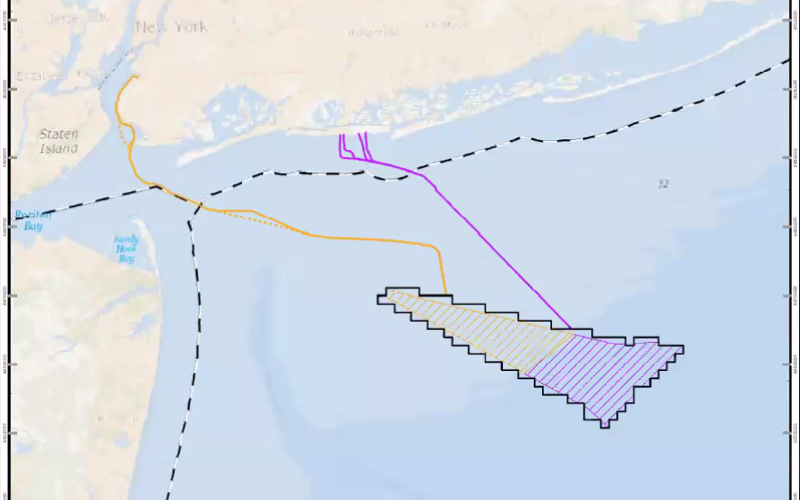

The worst of times. Also on Jan. 3, BP and Equinor announced they had terminated their Offshore Wind Renewable Energy Certificate Agreement with the New York State Energy Research and Development Authority for their Empire Wind 2 project off New York harbor. According to the Equinor press release: “The decision recognizes commercial conditions driven by inflation, interest rates, and supply chain disruptions that prevented Empire Wind 2’s existing OREC agreement from being viable.”

The decision came after the NYSERDA rejected the project’s request for a significant increase in their OREC agreement last fall. BP/Equinor wanted an increase in the OREC from $107.50 per megawatt-hour to $177.84. A 65.4% increase was too much for New York ratepayers in the judgment of NYSERDA. Considering the economic problems, the original Empire Wind 2 OREC price left the project “unfinanceable,” (our word of the year for 2023) according to the developers. The “out” afforded the developers was New York state allowing the project to rebid in this year’s offshore wind solicitation. That explains why Empire Wind 2 was not canceled.

BP/Equinor has an adjacent project, Empire Wind 1, with an OREC of $118.38/MWh. The developers had asked for that rate to be hiked to $159.64/MWh, which was rejected by the regulators, like the Empire Wind 2 request. As Empire Wind 2 is about 50% larger than Empire Wind 1 (1,260 MW vs. 816 MW), we wonder whether BP/Equinor will try to secure a high-priced contract for Empire Wind 2 in the upcoming solicitation and then merge the two projects such that the blended price earns a respectable return for the developers.

This is an election year, and the Biden administration will be trying to burnish its green energy credentials. Expect to see all the stops pulled out to accelerate offshore wind development, which will be supported by an avalanche of press releases claiming industry firsts and trumpeting the huge economic benefits for the host states. Ratepayers had better hold onto their wallets when the electric bills arrive after they vote.