The biggest offshore wind energy lease auction to date brought in $405 million for three tracts off New England, in what federal officials call a signal of momentum for the budding U.S. industry.

“Wow. It’s the highest-grossing (wind power) lease ever. We are truly blown away by this result,” said Walter Cruickshank, acting director of the federal Bureau of Offshore Energy, in a telephone press conference shortly after 32 rounds of bidding closed around 11:20 a.m. Friday.

Starting at 9 a.m. on Dec. 13, 11 of 19 qualified offshore wind companies put in their bids until Equinor, Mayflower Wind Energy and Vineyard Wind were the last standing, with winning bids of $135 million for each of three tracts totaling 390,000 acres. Three years ago, the same areas got no industry interest in BOEM’s first offering on the outer continental shelf south of Martha’s Vineyard.

“It’s indicative of the strength of the growing industry for offshore wind energy,” said James Bennett, who leads BOEM’s renewable energy program. “I think what you’ll see with these leases in place is tremendous acceleration down to Virginia.”

So far BOEM has leased 12 tracts on the outer continental shelf off the East Coast, with seven site assessments underway and two construction and operations plans under review by the agency, said Cruickshank. The latest auction “makes me very optimistic about the future of wind energy in this country,” he added.

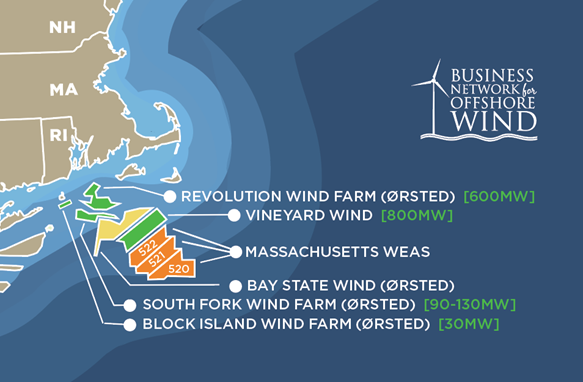

Response to the leases offering was driven by Massachusetts state policy promoting wind power, Deepwater Wind’s success with its 30-megawatt Block Island Wind Farm demonstration project in Rhode Island, and interest in potential future lease areas now being examined by BOEM, Cruickshank and Bennett said.

The agency and wind developers are still dealing with issues over those earlier leases granted off southern New England, particularly the commercial fishing industry’s intent to have adequate vessel transit lanes and turbine setbacks for safe navigation. Discussions are ongoing too with other government agencies over radar interference from rotor blades and how that can be mitigated, said Bennett.

One measure might be to have Automatic Identification System (AIS) transponders on turbine towers, so mariners can clearly identify them on radar, suggests Kevin Wark, a commercial fisherman from Barnegat Light, N.J., who is serving as a fisheries liaison to New Jersey state energy planners.

“There’s a lot of radar clutter out there,” Wark said Thursday evening, when the New Jersey Board of Public Utilities held a meeting in Atlantic City, N.J., in preparation for committing to buying 1,100 megawatts of offshore power.

The board will “take the time to listen to stakeholders and learn what their concerns are,” said Anne Marie McShea of the BPU. “We’re looking for (wind power) proposals that deliver not only the best price, but the best value.”

For New Jersey state officials, that means favoring wind power plans that can develop new jobs in the state with marine trades, manufacturing and operating and maintaining offshore turbine arrays. Denmark-based Ørsted is one frontrunner for a New Jersey power commitment, with a federal lease in place east of Atlantic City and an office already set up in the state.

“Obviously the political environment was very supportive of offshore wind. That was key for investing here,” said Elisabeth-Anne Treseder, a senior policy advisor with Ørsted.

The New York Bight waters between New Jersey and New York are ideal for developing the industry, with consistently reliable winds and “shallow water near the load centers” and sea floor geology that can support turbine arrays, said Rich Baldwin of consultants Ramboll Group A/S, an advisor to the BPU.

New Jersey’s existing deep water port facilities, like Paulsboro on the Delaware River near Philadelphia and the New York Harbor complex, can put the state in a position to lead on offshore wind power construction, said Baldwin. For moving components for the coming generation of big turbines, with rotor blades more than 300’ long, “the marine infrastructure is going to be really critical to the effort,” he said.

There will be a need for new larger, U.S.-flag and Jones Act-compliant heavy lift vessels to install towers, generator housings and rotors, said Baldwin.

Between ambitious goals set already by East Coast states, “the 3,500 megawatts (proposed generation capacity) gives us a pipeline…for manufacturing and vessels,” he said.

The New England auction results are telling, said Liz Burdock, president and CEO of the nonprofit industry group Business Network for Offshore Wind.

“Remember that just three years ago, these lease areas had no bidders at all. This strong interest from the offshore wind marketplace demonstrates the economic potential of the offshore wind industry,” Burdock said in a prepared statement after the auction.

She added that some of the federal government’s lease sale proceeds should be plowed into “developing grants and programs that invest in port infrastructure upgrades and support U.S. companies seeking capital investments to become part of the supply chain…payments by developers to lease ocean waters should benefit all parties involved, including state ratepayers, high-skilled workers and supply chain businesses in the industry.”

The auction results show the U.S. offshore wind industry “is clearly set to soar,” said Randall Luthi, president of the National Ocean Industries Association. But Luthi said maintaining that momentum will depend on BOEM developing “a reliable inventory of regularly scheduled offshore wind sales and the ability to develop those resources.” Opposition to seismic surveying, as environmental groups have marshalled in a campaign against oil and gas exploration off the East Coast, could likewise hamper wind developments, Luthi warned.

“Unfortunately, a long-term pipeline of wind lease sales does not currently exist. In fact, with the exception of a sales proposed offshore New York or potentially California in 2020, there aren’t any future lease sales scheduled, leaving nothing upon which developers can plan future investments."

NOIA has called for BOEM to schedule leases with the potential for at least four 500 MW developments annually, to a target national goal of 20 gigawatts by 2034.