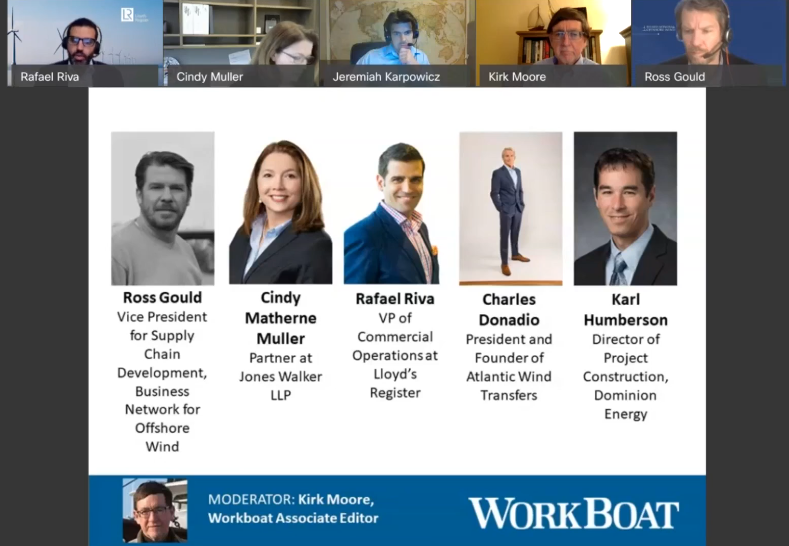

WorkBoat’s recent Operating on the (Wind) Farm webinar saw experts from all corners of the industry discuss updates that will define the future of offshore wind across the U.S. Representatives from the Business Network for Offshore Wind (BNOW), Jones Walker, Lloyd’s Register, Atlantic Wind Transfers and Dominion Energy connected to discuss details associated with the key developments we’ll see in this sector over the coming weeks, months and years, how ports will be affected, how certain regions will see changes more than others, and much more.

Numerous questions from the audience were submitted during the webinar and the panel was only able to address a handful of them. Charles Donadio from Atlantic Wind Transfers and Chris Pfisterer from Lloyd’s Register took the time to separately answer many of them, which you can read below.

To stay up to date with the latest developments in the offshore wind sector, be sure to download the latest Workboat + Wind digital publication and sign up for our weekly newsletters if you’re not already subscribed.

Q: The scope of the wind service vessel newbuild plan is expanding around the U.S. This is fantastic. In the meantime, however, is there an effort to repurpose existing assets to cover the delta until these newbuilds become a reality?

Charles Donadio: It will be difficult to re-purpose existing vessels to full fill the needs of Crew Transfer Vessels as they need to meet a very specific task and meet rigorous safety standards. As forSOV’s we will most likely see new build for these tenders not to say there are not any suitable SOV’s that would be re-purposed and the WTIV Installation Vessel they just do not exist here in the U.S.

Q: Coming from offshore drilling, it is hard to comprehend that taking an expensive day rate WTIV out of the field to load turbines is more cost effective. You would think keeping the WTIV working 24/7 and supply on sight would be more effective.

Chris Pfisterer: This is a concept that is widely discussed. The idea is to have the WTIV remain in the field for installation and utilize various feeder barges to deliver the equipment to the field. LR has entered into a joint development project with Northeast Technical Services Co. Inc. to design and develop a Jones Act-compliant wind turbine installation vessel that includes a feeder barge system. LR understands the logistical challenges with the various ports along the East Coast which allows us to understand the operational impact when considering the design, sizes, etc.

Q: Have there been any studies of how many jobs will be created? And what training programs could be set up?

Workboat Editors: There are numerous studies that detail the potential value and jobs that offshore wind represents. According to Rystad Energy, wind at sea will employ 868,000 full-time globally by the end of the decade. Researchers said the hiring spree will be notable in the next few years, as job demand could reach almost 600,000 by 2025. These wind energy-related jobs could create $100 billion of market opportunities in manufacturing, operations, construction, as well as transportation, and marine services.

Training programs are currently being developed at different levels by various organizations. Two examples of this training can be seen with the Foundation 2 Blade program from the Business Network for Offshore Wind and US Offshore Wind Training from the Massachusetts Maritime Academy.

Q: Due to the WTIV shortage will we see Jones Act waivers or reflagging?

Charles Donadio: I do not believe the U.S. government is going to allow any foreign flagged vessels to enter this new U.S. offshore wind market. There has been a large effort to keep the vessel sourcing to USCG Jones-Act-Compliant vessels thus allowing the local U.S. shipyards to benefit from the demand that will come from this new industry. We will see the concept of an overseas Jack-up Installation Vessels being a key component working with U.S. feeder barges going forward until there are U.S. built Installations Vessels come online.

Q: What's happening on the U.S. West Coast? Will the Jones Act and sea bottom conditions make companies start looking at options like Gravity Base structures, which can be towed out?

Workboat Editors: Turbines that are held by mooring lines attached to anchors in waters deeper than 160 feet are being considered for wind farms on the West Coast, where the waters are much deeper. For other developments on the West Coast, California state Assemblyman David Chiu of San Francisco recently introduced a bill that sets a target for the state of generating 3,000 megawatts of offshore wind by 2030 and 10,000 megawatts by 2040.

One of the biggest challenges for offshore wind development on the West Coast is the potential impact on commercial shipping. California waters that already have heavy vessel traffic could become even more congested with possible rerouting and a need for maneuvering around these wind farm operations. Offshore wind operations could cause delays or disruptions to routes that ships have typically used. Similar to cooperation between offshore wind and the maritime industry on the East Coast, there will need to be regular dialogue between maritime companies and offshore wind operations.

Q: Given the current shortage of vessels and push to fill the void, are there concerns about a shortage of operators/crews? Are Jones Act-compliant companies adequately preparing to train and crew such vessels?

Charles Donadio: There will indeed be a shortage of trained crewmembers as this industry pushes forward. We as a CTV operator are planning to train new crewmembers a year in advance of any potential expansion so that we as a company will be well prepared. It is going to be a challenge for other operators to get their Captains and deck crew professionally trained here in the U.S. as there is no such hands-on training facility and sending crew overseas to a European wind farm are becoming exceedingly difficult.

Q: How important will domestic suppliers be for wind turbine construction for offshore wind in U.S. waters? Will there be something like the Jones Act for wind turbines installed on U.S. shores?

Chris Pfisterer: The lack of Jones Act-qualified compliant wind turbine installation vessels has become a major challenge for offshore wind turbine developers. With years of research and development in this industry, LR joined forces with NETSCo to collaborate on efforts to better support the offshore wind turbine market with a Jones Act-qualified vessel alternative, as well as offering conversion options for vessels that have been drydocked during this economic downturn. To read more about the collaboration and how we can support you, visit our page here.

Q: Do you have estimates for how many dedicated WTIVs will be needed to support power needs in the next five to 10 years?

Workboat Editors: The global shortage of WTIVs has the industry speculating how high day rates now around $180,000 can go.

There were only 32 of these wind turbine installation vessels in the world in 2020, according to a recent analysis by Norwegian firm Rystad Energy. Perhaps 14 of those are able to handle the latest larger turbine assemblies – and those generators and their towers are getting bigger.

Even though more are being built, the global fleet won’t be enough to meet offshore demand beyond 2025, according to Rystad.

For the past few years, this has effectively resulted in a relatively oversupplied market, especially in Europe. However, the scale is clearly expected to tip towards an undersupply of installation vessels by the mid-2020s. With more offshore wind projects down the line, Rystad Energy expects installation vessel demand will be four to five times higher than today’s figure by 2030.

Moreover, there are currently only four vessels capable of handling the next generation of turbines, such as GE’s Haliade-X 12-MW (or 13-MW in boosted mode), which is expected to be commercial in 2021. As technology advances and future-generation wind turbines will get even bigger, the existing fleet of vessels is not likely to have enough capacity to install them.

Across the global fleet of installation vessels that Rystad Energy tracks, we have observed an average installation speed of 3-4 days per vessel per monopile. In contrast, the duration of turbine installation varies more widely at anywhere between 2-5 days, mainly due to the expected weather implications when lifting blades and hub components above significant heights in windy areas.

Naturally when it comes to hoisting heavy equipment over 100 meters from the water line, installation vessels must be able to carry out the job in a safe and precise manner. Offshore crane capacity, lifting height, and ample deck space are just some of the main competitive factors these units offer, and continue to evolve.

Between 2000-2010, the offshore wind market’s slow growth and relatively light equipment (2-4 MW turbines) posed no real challenge to the existing fleet. Yet in 2014-2015 turbine sizes began to increase substantially, especially in Europe, and with them the need for larger crane capacities and lifting height. Early players in the vessel market were able to anticipate this shift and optimize fleets to serve these larger projects. Nevertheless, it is evident that competitive features that were considered “high-spec” only three years ago are already outdated.

Q: Can CTV operators describe how they want hybrid vessels to work? Or just in port? Or just port and loitering? Or even just to fill in at low power levels before the main engines take over?

Charles Donadio: The hybrid solutions for CTVs are just at the beginning stages of development in Europe. In the coming years we will begin to see solutions that become more reliable and affordable and will provide the return on the investment for the operators and charterers. Atlantic Wind Transfers will be working toward lowering NOx emissions on all future CTV contracts with future goals towards Net Zero Emissions.

Q: Are there projects being planned for the Gulf of Mexico, with low wave action and relatively shallow waters close to shore?

Workboat Editors: While the winds in the Gulf are not as powerful as they are on the coasts, there is still opportunity to develop the technology in this region. To illustrate this interest, Louisiana Gov. John Bel Edwards recently announced a renewable energy initiative for the Gulf of Mexico, which revolves around offshore wind.

WorkBoat’s Jim Redden mentioned that within a decade, the Gulf of Mexico shelf could generate cost-competitive wind energy with two sites off Texas and another off the Florida coast. These are seen as the most likely landing spots for inaugural offshore wind farms in the Gulf.

Q: Who do we contact about getting our product specified?

Chris Pfisterer: Lloyd’s Register is happy to support product or component certificated or type approval. To learn more about our Type Approval, visit our page here.