Israel faced an extensive and unprecedented assault from Hamas on Oct. 7. This Palestinian militant group, which has controlled the Gaza Strip since 2007 and has close military and financial connections with Iran, launched airstrikes and infiltrated Israeli territory from both the Gaza and Lebanon borders. Several countries, including the U.S., label Hamas as a terrorist organization.

The attack coincides with the 50th anniversary of the world’s first oil crisis. Unlike in 1973, Arab countries are not united in their assault against Israel. While the immediate repercussions on oil markets might not mirror the events that took place 50 years earlier, secondary effects may be significant in the days to come.

The impact on crude supply from countries directly involved in the conflict is expected to be relatively limited. While the Israeli Energy Minister recommended shutting offshore operations, Israel's total crude production hovers around 20,000 barrels per day (bpd). In terms of crude demand, refinery capacity in the region amounts to approximately 300,000 bpd, mostly feeding internal fuel supply. There are no clear indications yet of refineries shutting down due to the conflict as of now.

The most pronounced impact on the oil market is anticipated from secondary drivers, primarily stemming from the relationship between the Iranian government and Hamas. An immediate concern is the potential Israeli perception that Iran actively collaborated in the actions, leading to a direct escalation against Iran. While such an escalation remains unlikely, if it were to occur, it could mean a disastrous amplification of the regional conflict. A more probable outcome is Israel framing the narrative against Iran, pressuring its most important ally the U.S. to pullback on the recent softening in relations with Tehran under President Joe Biden’s administration. Iranian crude exports have surged by over 700,000 bpd between the first quarter of 2021, at the beginning of the Biden administration, and the third quarter of this year (Figure 1).

This increase can be attributed to a marked rise in the share of exports to China over the recent years. A stricter enforcement of sanctions on Iranian oil could be the most significant repercussion in the coming months. This would compel China to diversify its supply sources, enhancing Saudi Arabia's market leverage and potentially alleviating pressure on other sanctioned countries such as Russia and Venezuela.

Another possible secondary effect would be a halt in the diplomatic normalization process between other Islamic nations like Saudi Arabia and the UAE. According to a media report published just before the attack, Riyadh had hinted that it might ramp up production early next year if oil prices remain elevated. This deal might see the Kingdom recognizing Israel in exchange for a defense agreement with Washington. If Saudi Arabia chooses to extend its voluntary production cuts into 2024, market tightness is set to persist, sustaining even higher oil prices next year and putting pressure on fuel costs and inflation in an election year in the U.S.

The U.S. is currently in a different position than it was in early 2022 during the onset of the Russia-Ukraine war. After a massive release of 230 million bbls from its reserves, the U.S. now has less flexibility to use its strategic reserves in response to potential crude supply shocks.

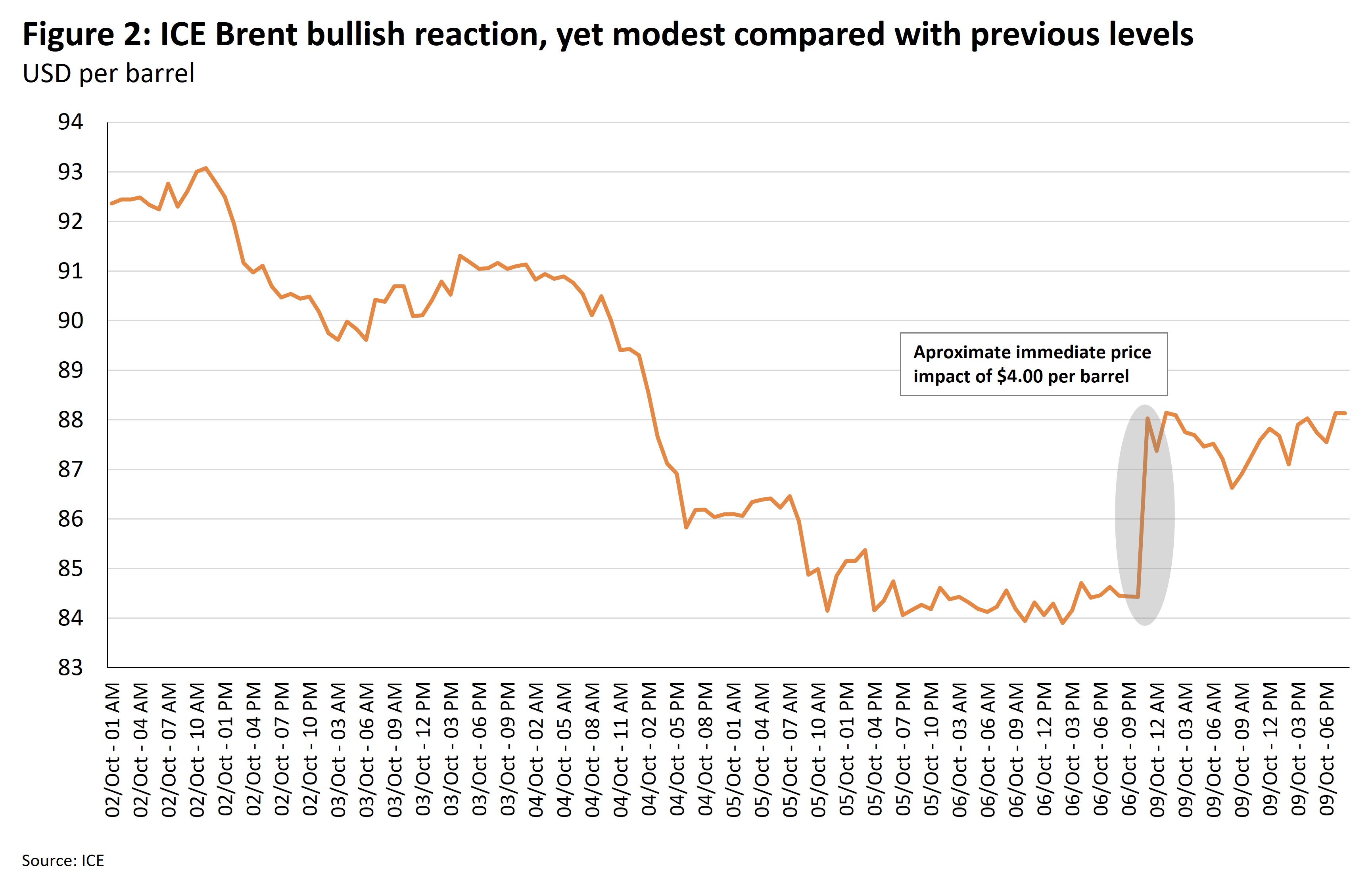

Crude price movement has shown a cautiously bullish trend since the weekend. The ICE Brent December 2023 futures is experiencing an increase of around $3-$4 per barrel compared to Friday's close but have yet to rebound to the $90-bbl level observed in the previous weeks (Figure 2).

Our price call, as presented in October's Oil Market Monthly Report on Oct. 6, remains unchanged. We forecast an average of $91 per barrel in the fourth quarter and $89 in 2024. However, given the recent events, the risk balance is now leaning more towards our high-case scenario in the upcoming quarters. This shift is particularly contingent on the secondary ramifications of the conflict, with a special emphasis on potential Iranian state involvement.

Signposts

- Conflict escalation: Israeli forces are amassing in preparation for a potential ground assault on the Gaza Strip. The situation is volatile, and any incursion could significantly intensify the conflict.

- Hamas' backing: Clarity over Hamas’ foreign support, especially from Iran. Confirmation or refutation of Iran's role could influence the trajectory of the conflict and international responses.

- Western stance: The focus is on how Western nations, particularly the U.S., will react. If Iran's active involvement is substantiated, there might be a more robust response, including the potential tightening of sanctions on Iranian crude exports.

- Saudi Arabia's position: The stance of Saudi Arabia is crucial, especially given its agreement with the White House and its diplomatic ties with Israel. Any shift could also impact the Kingdom's voluntary reduction of 1 million bpd in oil production, which would have ripple effects on global oil markets.