The phrase to familiarize yourself with above all others this year is “hard market.” Insurance is subject to a range of forces — claims activity, social inflation in jury awards, stock market performance, inflation and the overall state of the economy, the availability and affordability of reinsurance, the end of an era of cheap capital, geopolitical concerns, and climate instability, among others. These factors combine to harden the market by driving insurers into a defensive posture to protect their balance sheets.

In a hard market, premiums increase, underwriting becomes more selective, the capacity to offer policies decreases, and insurance carriers become less aggressive competitors. There’s no point in soliciting your competition’s customers if you don’t have the capacity to write the risk.

Inflation and labor issues are big drivers of disruption, as is the drying up of the cheap capital well (which funded large tranches of reinsurance) and the challenging performance of the financial markets — most insurers invest portions of the premium they collect to offset claims losses and to generate additional revenue.

In the marine universe, the supply and cost issues around energy and distillates, the war in Ukraine, climate-driven uncertainty, record-smashing hull, cargo and property claims, huge settlements, and nuclear jury awards on P&I claims all have insurers battening the hatches.

We are also seeing other longer-term trends in the economy having increasing impacts on insurance. Environmental, Social & Corporate Governance (ESG) concerns are coming to the fore and will likely feature more heavily in approaches to underwriting.

Already, some insurers and reinsurers are declining to take on new hydrocarbon business. State legislatures in oil and gas states are less than impressed. AI, machine learning and increased automation will also continue to decouple the person from the process when it comes to underwriting and quoting coverage.

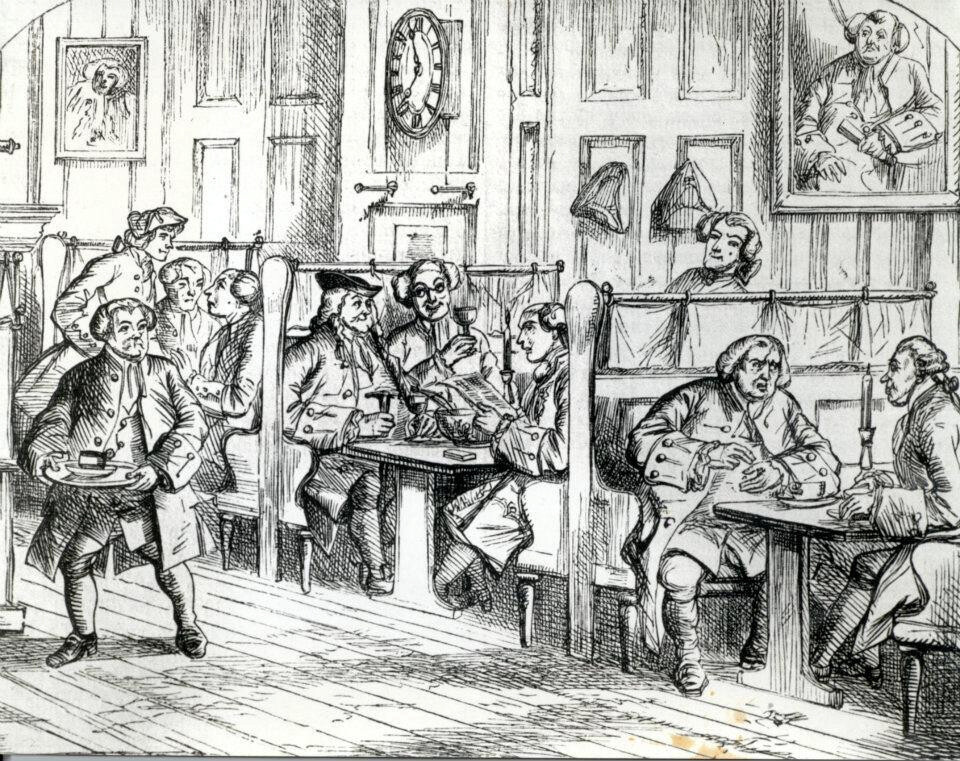

This will mean potential expense savings for insurers, but will they pass these on to customers? And what impact will robo-underwriting have on the quality of the product that has been driven by the expertise of actual people since the early days at Lloyd’s Coffee House?

What can individual operators and companies do to offset this? Well as the old saw has it, quality will out. A good risk will still be attractive to insurers, even in a time of retrenchment. Making sure you are paying attention to the details like vessel or yard housekeeping, culture, safety management systems, maintenance and training, loss-control recommendations and working with your insurance agent will put you in the best position to weather the storm.

Hard markets are no fun for anyone, but a proactive and prepared business can avoid most of the issues they cause.