A surprising development in the Biden administration’s rush to build 30 gigawatts of offshore power – a proposed offshore wind farm was rejected because its power is too expensive.

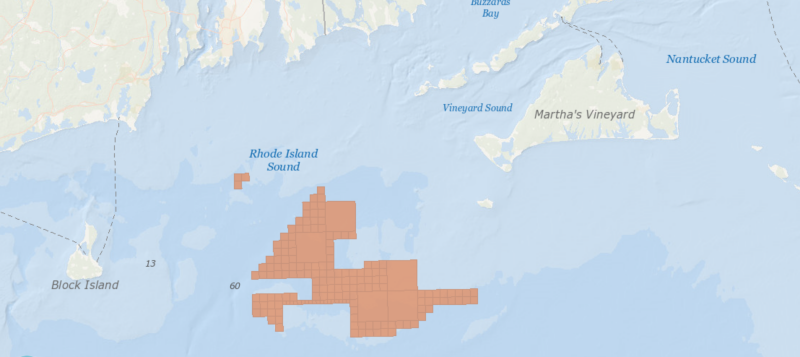

The 884-megawatt Revolution 2 wind farm, a joint project of Danish wind developer Ørsted and New England utility company Eversource, was to be located off the Rhode Island coast between Block Island and Martha’s Vineyard. It was the only bid submitted in the state’s October request for an additional 600-1,000 MW of offshore wind power to help the state meet its goal of 100% clean energy by 2033.

Last week, Rhode Island Energy, the state’s primary electric utility, announced it “has decided that it will not be moving forward on a long-term power purchase agreement (PPA) with Ørsted and Eversource.” The utility stated it had gone through “a thorough, four-month evaluation of the bid” in consultation with the Rhode Island Office of Energy Resources and the Division of Public Utilities and Carriers, and “the proposal did not meet all the requirements as detailed in the Affordable Clean Energy Security Act (ACES).”

Rhode Island Energy also said in its press release that “the economic development benefits included in the proposal were weighted and valued appropriately by our evaluation team, but ultimately it was determined those features did not outweigh the affordability concerns and other ACES standards.”

The company acknowledged the ongoing financial turmoil in the offshore wind industry. “Higher interest rates, increased costs of capital and supply chain expenses, as well as the uncertainty of federal tax credits, all likely contributed to higher proposed contract costs,” stated Rhode Island Energy after reminding that “affordability and reliability” were the key metrics used in the evaluation process. The telling message from the utility was “those costs were ultimately deemed too expensive for customers to bear and did not align with existing offshore wind PPAs.”

Does this mark the opening shot in a battle between offshore wind developers and ratepayers over how to balance costs and still meet coastal states aggressive clean energy mandates?

Rhode Island Energy indicated that within 60 days it will outline the elements of why the proposal did not meet the ACES requirement “to reduce energy costs” and other factors that scored low in the evaluation. The company noted that both state agencies will also file comments and the developers will have an opportunity to respond to the findings.

Interestingly, ACES was enacted in 2019 and was designed to provide relief for coal-fired power plants to meet emissions and clean energy standards. It encourages the use of the “best system of emissions reduction (BSER).” The act says that “in determining the BSER, EPA considers technical feasibility, cost, non-air quality health and environmental impacts, and energy requirements.”

I wonder if this is a hint that since it is part-time energy, the emissions of the required backup power reduce offshore wind’s benefits, tipping the cost/benefit analysis against ratepayers? There will be more to learn in the coming days.