Higher oil prices and lower costs for offshore projects are driving increased demand for offshore drilling rigs through 2020, particularly for deepwater projects, according to new analysis released yesterday by IHS Markit.

In its first worldwide mobile rig forecast for 2020, IHS Markit, which relies on data from its Petrodata RigPoint database, estimates that the average global demand for mobile offshore drilling units, made up of jackups and floating rigs, is expected to increase by 15% between 2018 and 2020 as the offshore market slowly emerges from its prolonged downturn.

IHS Markit expects global offshore rig demand will average 521 units in 2020, topping the average of 453 units expected through 2018.

“Broadly speaking, much of this increase in global demand can be attributed to the price of oil being sustained at a higher level than when the downturn was in full swing,” said Justin Smith, offshore rig analyst at IHS Markit and an author of the rig forecast. “In addition, costs associated with the offshore industry have been slashed in recent years. This has led operators to reconsider exploration, appraisal, and development programs that were not economically viable while the market was bottoming out.”

While the demand for shallow water jackups will improve during this period, the increase will primarily be driven by floating rigs, specifically semisubmersibles and drillships, as operators step up activity in deepwater areas around the globe, IHS Markit said.

“The vast majority of this offshore rig demand increase will come from the Middle East, led by Saudi Arabia, and other notable additions in Qatar and the United Arab Emirates,” Smith said. “Saudi Aramco alone will account for roughly a third of this increase as the operator continues its push for more offshore production, a sentiment echoed by Qatargas, which is aiming to increase its liquefied natural gas (LNG) exports.”

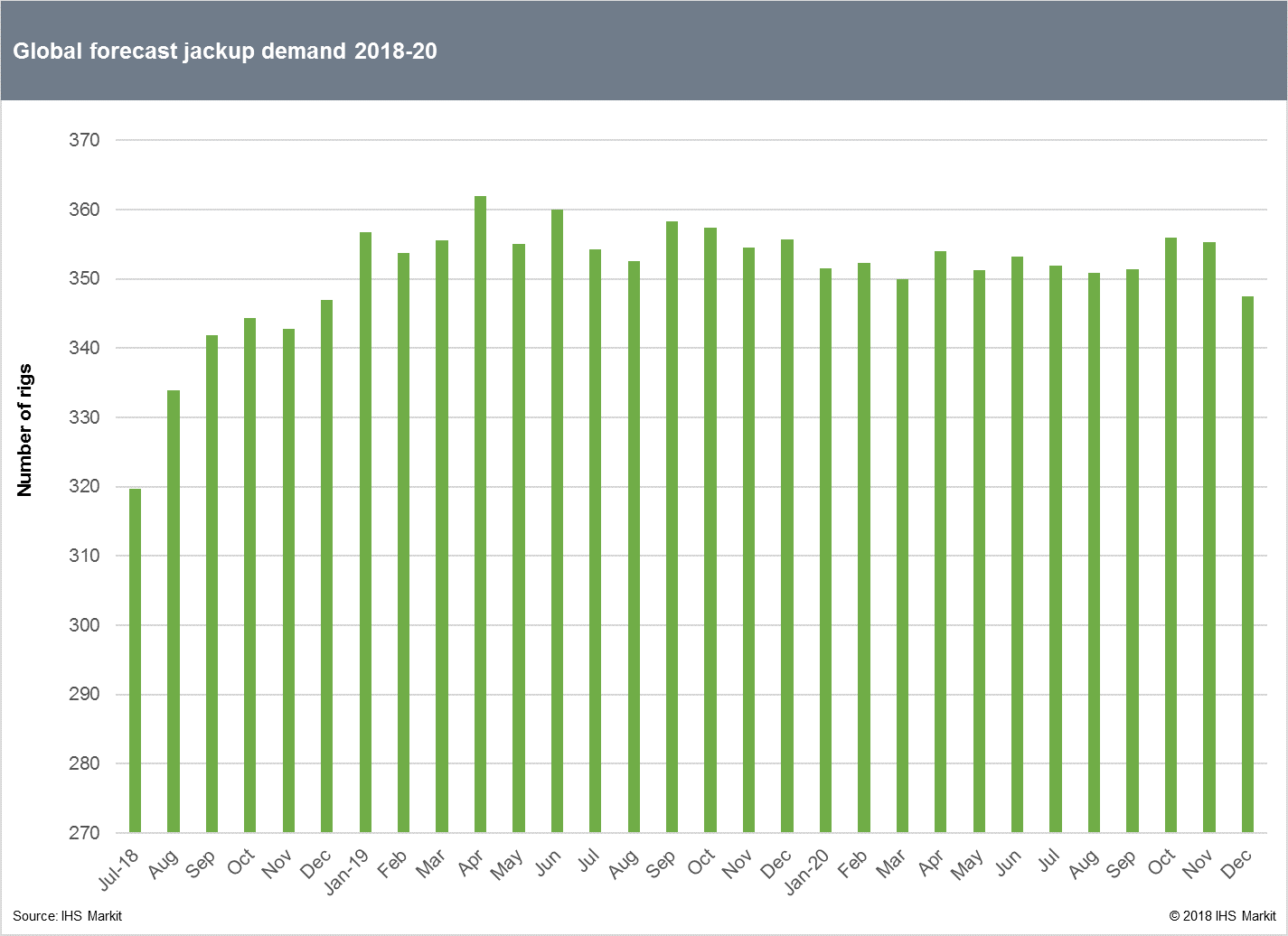

For jackups, demand is expected to climb from an average of 321 rigs this year to an average of 352 in 2020, an increase of 9.7% during the period. Meanwhile, smaller upticks in the jackup rig segment are expected for several regions, including Northwest Europe, Central America, West Africa and the Indian Ocean.

The U.S. Gulf of Mexico has made a considerable rebound from its lowest point of the downturn, which was four contracted units in October 2016. This year, the U.S. Gulf jackup sector is expected to average about nine units, increasing to 11 by 2020, with potentially more on top of that should local operators decide to undertake additional drilling programs, Smith said.

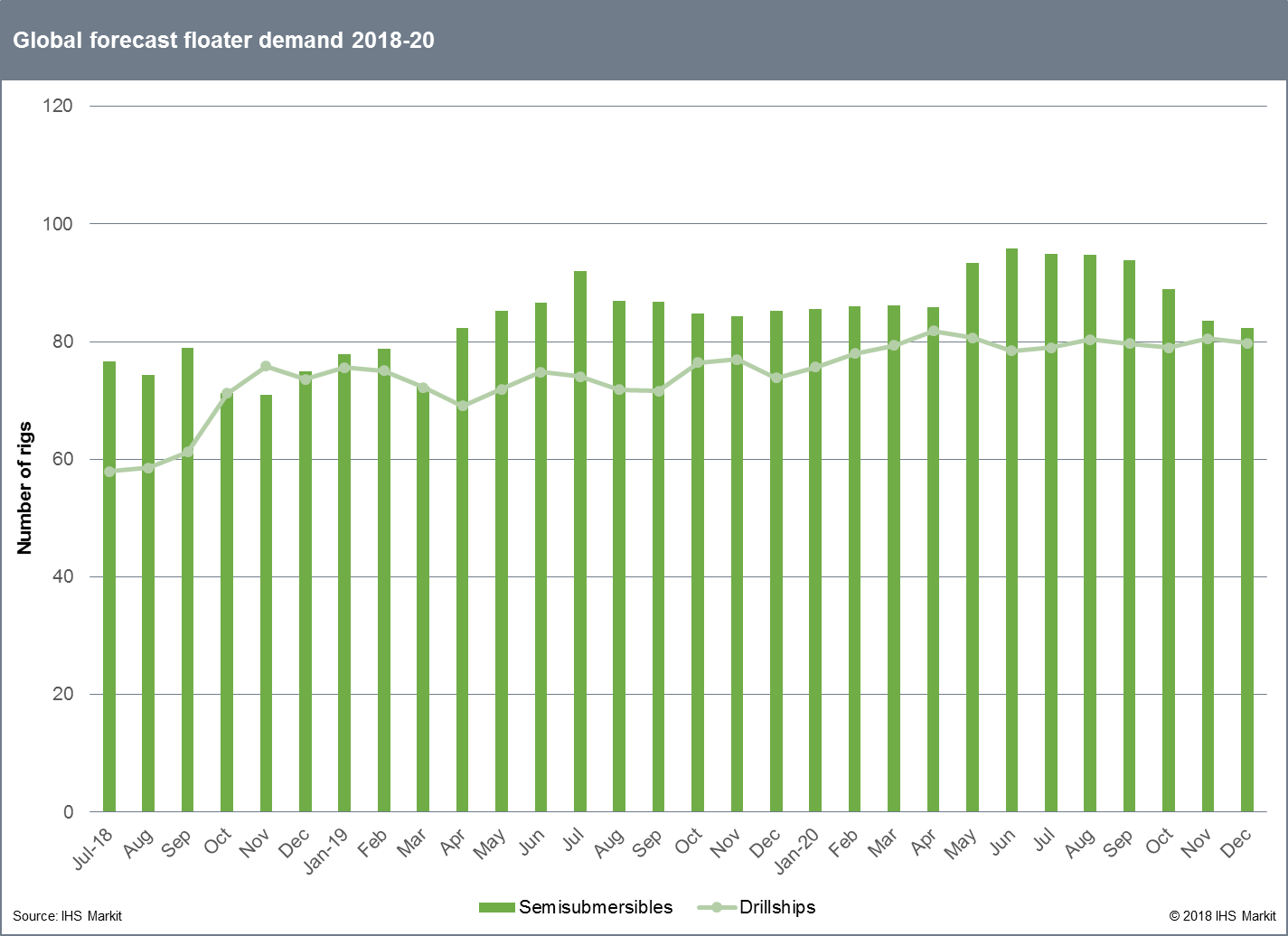

In the floating rig market, average annual semisubmersible rig demand is forecast to increase substantially in the short-term, by more than 25% from an average of 71 units in 2018 to 89 units in 2020. Northwest Europe is responsible for a third of this expected improvement.

“Fairly significant contributions to the semisubmersible rig demand are also coming from North and South America, as well as in the Asia Pacific market,” Smith said. “While not as busy as some other regions, semi-submersible demand for Australia/New Zealand and the Indian Ocean, especially Myanmar, is anticipated to increase, but the numbers for Southeast Asia and the Far East are likely to stay flat going into 2020, if not fall very slightly.”

Similarly, a significant increase is anticipated for the drillship segment of the floating rig market. Drillship demand in 2020 will average 79 units, a 27% increase from the average demand of 62 units for 2018. North and South America will be responsible for most of this growth. In North America, the increase is mostly attributable to operators being reinvigorated to invest in development programs, while South America is benefiting from ExxonMobil’s exploration successes in Guyana and an influx of new operators in Brazil’s pre-salt areas, IHS Markit said.

Deepwater rigs, defined by IHS Markit as units that can operate in more than 3,000' of water, will see the most improvement with a number of longer-term programs set to begin in 2019 and to run through 2020 and beyond.

“While fewer rig contracts have been signed during the last several years, we know that operators are making more plans for the future, and that growth is indicated in our forecast,” Smith said. “Once companies release their 2019 budgets, we expect greater clarity as to how their leaders perceive the long-term health of the offshore market. Even without seeing their budgets yet, it is understandable that operators would want to take advantage of current cost reductions, which is being borne out as the number of tenders in the market for rigs has grown significantly this year."

Rig utilization rates have been slowly improving this year, a trend that is expected to continue. The total utilization of jackups, semisubmersibles, and drillships, which is defined as the share of all of rigs that are contracted regardless of whether the rigs are actively being marketed as available for future contracts, hit a floor of 51% at the end of 2017 after more than a year at this level. Total utilization is now 56% and should keep climbing slowly as market conditions continue to improve, IHS Markit said.