In its Feb. 8 Short-Term Energy Outlook, the Department of Energy’s Energy Information Administration (EIA) forecasts that average 2022 prices for both crude oil and diesel fuel will decrease.

Brent crude oil spot prices averaged $87 per barrel in January, a $12 bbl increase from December 2021, the EIA said in its February report. Crude oil prices have risen steadily since mid-2020 as result of consistent draws on global oil inventories, which averaged 1.8 million barrels per day (b/d) from the third quarter of 2020 through the end of 2021.

The EIA estimates that global oil inventories fell further in January. "Oil prices have also risen as result of heightened market concerns about the possibility of oil supply disruptions, notably related to tensions regarding Ukraine, paired with receding market concerns that the Omicron variant of Covid-19 will have widespread effects on oil consumption," the EIA said.

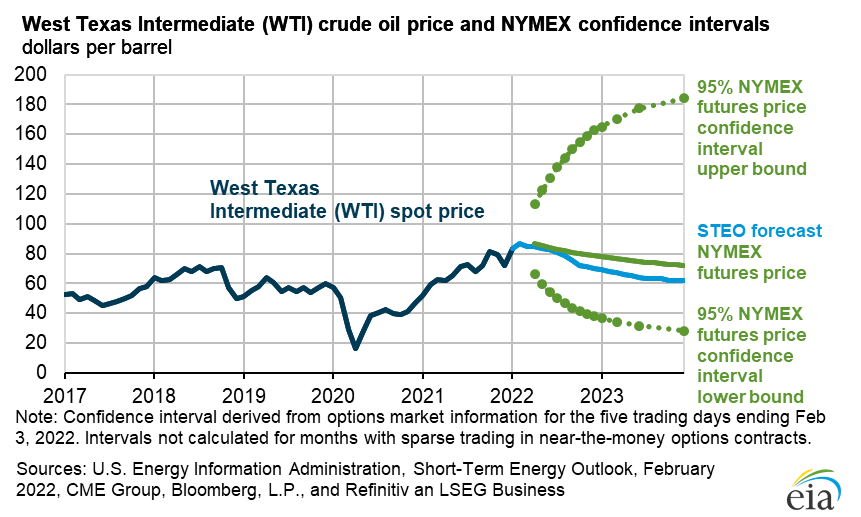

The EIA said it expects that "Brent prices will average $90 bbl in February as continuing draws in global oil inventories in our forecast keep crude oil prices near current levels in the coming months. However, we expect downward price pressures will emerge in the middle of the year as growth in oil production from OPEC+, the United States, and other non-OPEC countries outpaces slowing growth in global oil consumption.

"This dynamic leads to rising global oil inventories from 2Q22 through the end of 2023, and we forecast the Brent spot price will fall to an average of $87/b in 2Q22 and $75/b in 4Q22. We expect the Brent price will average $68/b for all of 2023.

"However, low inventory levels create an environment for potentially heightened crude oil price volatility and potential risk for prices to rise significantly if supply growth does not keep pace with demand growth. Global supply chain disruptions have also likely exacerbated inflationary price effects across all sectors in recent months. How central banks respond to inflation may affect economic growth and oil prices during the forecast period," the EIA said.

The EIA estinates that global oil inventories fell further in January — compared with the EIA's expectation of an increase in last month’s Energy Outlook — and that commercial inventories in the OECD ended the month at 2.68 billion bbls, the lowest level since mid-2014. Oil prices have also risen as result of heightened market concerns about the possibility of oil supply disruptions, notably related to tensions regarding Ukraine, paired with receding market concerns that the Omicron variant of Covid-19 will have widespread effects on oil consumption, EIA said.

The EIA report also said:

- U.S. regular gasoline retail prices averaged $3.31 per gallon (gal) in January, unchanged from December 2021 and up 98 cents/gal from January 2021.

- U.S. crude oil production reached almost 11.8 million b/d in November 2021 (the most recent monthly historical data point), the most in any month since April 2020. EIA forecasts that production will rise to an average of 12 million b/d in 2022.

- In January, the natural gas spot price at Henry Hub averaged $4.38 per million British thermal units (MMBtu), up from the December average of $3.76/MMBtu.

- The share of U.S. electric power sector generation produced by natural gas will average 35% in 2022 and 2023, down from 37% in 2021.

- The EIA expects U.S. coal production to increase by almost 28 million short tons (MMst) (5%) in 2022 to 606 MMst and then rise by 18 MMst (3%) in 2023.