Denmark-based offshore wind energy developer Ørsted announced it will pay $510 million to acquire Deepwater Wind, the Providence, R.I., company that has the Block Island Wind Farm and half a dozen offshore wind plays off the U.S. East Coast.

“The two companies’ offshore wind assets and organizations will be merged into the leading US offshore wind platform with the most comprehensive geographic coverage and the largest pipeline of development capacity,” Ørsted and Deepwater officials said in a joint statement Monday.

Deepwater is owned by D.E. Shaw & Co., a New York City hedge fund and investment firm, and built the first commercial offshore wind project of 30 megawatts at Block Island. The array is served by the Atlantic Pioneer, the first U.S. flag crew service vessel for the wind industry, launched in 2016.

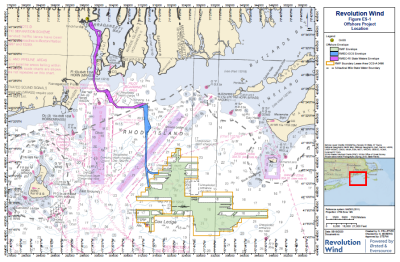

Deepwater’s larger portfolio includes three development projects off Rhode Island, Connecticut, Maryland and New York, totaling 810MW of capacity with long-term revenue contracts in place or pending finalization with state governments The company has another three leases from the federal Bureau of Offshore Energy Management, with potential to develop up to 2.5 gigawatts off Massachusetts and Delaware.

Ørsted has two major projects so far: the Bay State Wind site off the coast of Massachusetts, a joint venture with power supplier Eversource, and the Ocean Wind site off the coast of New Jersey. Together they have potential for around 5.5 GW, according to Ørsted.

In addition, Ørsted will be constructing two 6MW wind turbine positions for phase one of Dominion Energy’s Coastal Virginia Offshore Wind Project, and has exclusive rights with Dominion to discuss potential developing of up to 2GW of offshore wind capacity.

After closing the transaction, the name of the new organization will be Ørsted US Offshore Wind. The new organization will be represented by a local management team headed by Ørsted US Offshore Wind CEO Thomas Brostrøm, Co-CEO Jeff Grybowski, President and CFO David Hang both from the Deepwater Wind team, and COO Claus Bøjle Møller from the Ørsted team.

The transaction is subject to clearance by the US competition authorities and is expected to close by end of 2018.

“With the combined organization and asset portfolio, Ørsted will be able to deliver clean energy to the seven states on the US East Coast that have already committed to build more than 10GW of offshore wind capacity by 2030,” the company said.

“With this transaction we’re creating the number one offshore wind platform in North America, merging the best of two worlds: Deepwater Wind’s longstanding expertise in originating, developing and permitting offshore wind projects in the US, and Ørsted’s unparalleled track-record in engineering, constructing, and operating large-scale offshore wind farms, Martin Neubert, CEO of Offshore Wind at Ørsted, said in a prepared statement.

Grybowski of Deepwater Wind called Ørsted “one of the world’s great clean energy companies and real pioneers in the offshore wind sector.”

“We could not be more pleased with this combination, which will bring together two great teams to realize an enormous clean energy resource for coastal populations in the U.S.”