Let’s get organized. An inland barge company that has 2,500 barges and 150 towboats needs to know where these assets are along the inland waterways system at any given time. And if it’s a barge carrier with only 50 barges and 10 towboats, it’s just as important.

Whatever the numbers, there are a lot of moving parts operating along multiple rivers and canals, flowing through numerous states. In other words, a logistical problem within the dreaded supply chain.

And the last thing operators want is to not have answers to customers’ inquiries about where their cargo is or when it’s going to reach its destination.

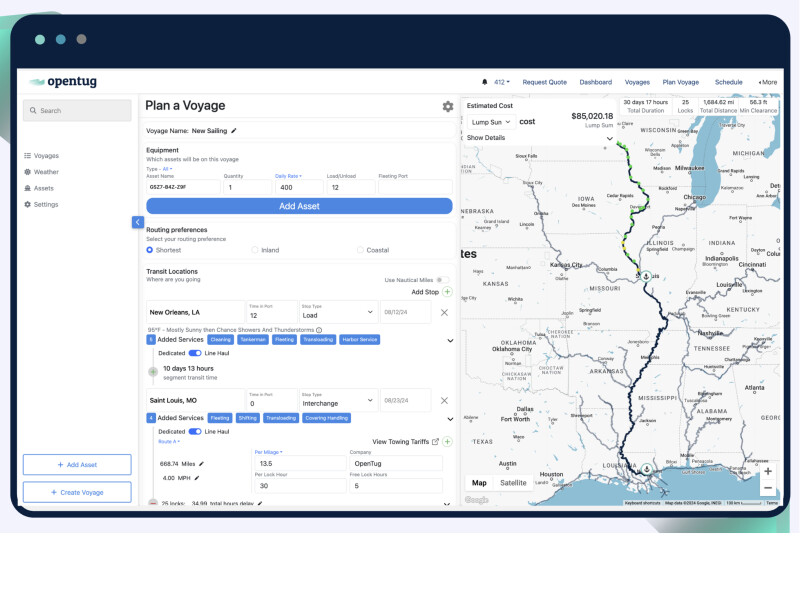

“We can use data so we don’t have to say we don’t know how long it will take to get where it’s going,” said Mike Baldwin, co-founder, OpenTug, a platform designed to increase efficiency and growth in the marine transportation market. “We can consolidate all data on one platform.”

DIGGING INTO DATA

Suppose there’s a problem locking through somewhere on the Upper Mississippi, and tows are stacking up like rush-hour traffic. “You have to make sure the customer knows that as soon as possible,” said Baldwin. “That’s when we’re most valuable, by our providing instant notification.”

Baldwin said if deviating from its original route is a possibility for a tow, the more information available, the better. “If you switch and you can say this is how long it’s going to take, then the carrier and the shipper can make more informed decisions based on the information given,” he said.

OpenTug, based in Seattle, was founded in 2019 on the belief that marine transportation doesn’t have to be complicated. The company’s “tools” are designed to help customers work more efficiently — working smarter, not harder.

The company exists within the U.S. barge industry with the goal of making cargo moves easier and more methodical for barge owners and operators. A shipper can go to the OpenTug website and find out which barge companies have what equipment available, instead of having to go to individual barge companies’ websites. OpenTug does the legwork and puts it all in one place. “I ask potential customers, ‘Where are your gaps? How are you giving your customer more visibility into where their cargo is moving?’” said Baldwin.

For shippers and agents, the OpenTug site offers online booking and booking management, filing of competitive bids from previous bookings, progress transparency, and document tracking and shipments.

For barge operators who employ people to gather this type of information and put it in a spreadsheet, those people can now put more of their efforts into planning instead of data gathering. “We’ve worked with a lot of barge companies,” said Baldwin. “We offer them a chance to do more planning and less managing. It’s more about time prioritization.”

It’s all to increase provider utilization and customer satisfaction, resulting in lower acquisition costs for providers and more competitive pricing for customers.

“We are creating a system that will align our goals with the operators,” Jason Aristides, OpenTug’s co-founder and director, told WorkBoat in an interview from 2023. “This system will allow more cargo to be moved by technology, which can do it cheaper and cleaner. And it can benefit the U.S. supply chain.”

Baldwin said Aristides got the original idea for OpenTug when he was working for Foss Maritime and observing how many empty barges were being moved along the West Coast to Alaska and back.

OpenTug makes its money by charging customers for the platform. Its monthly baseline rates are based on fleet size.

For that fee, a company gets a customized program that can include a specialized booking portal, made-to-order forms, direct integration with the website and the customer relationship management platform, in-app messaging, e-mail management, and file integration.

In addition, there are charges for specific add-ons. For example, OpenTug prices per tracker/per asset, and it charges for its artificial intelligence (AI) tool BargeOS Autopilot as an add-on.

As far as quoting, route planning, and cost-estimations tools, OpenTug offers instant quote generation based on the customer’s input, a drag-and-drop function for route adjustments, data feedback to help improve quoting and scheduling, access to real-time weather — lock, port, and terminal data, AI email nomination and ordering, and data analytics for forecasting as well as analyzing historical and current data.

And perhaps the most important tool of all — tracking. The customer gets to track its vessels and barges while underway; AIS location monitoring; minute-by-minute ETA, delay, and status updates; demurrage tracking; automated daily position reporting, historical voyage reporting; and standard and customized dashboards.

As mentioned, for customers who include the BargeOS Tracking and Autopilot service, OpenTug bills these as a service per asset tracked, instead of selling tracking devices themselves. This helps its customers by allowing OpenTug to handle the installation and support of the devices and reduces upfront capital costs.

FINANCIAL INFUSION

This spring OpenTug secured a $2.2 million strategic investment led by venture capital firm TMV, New York. The funding round brings OpenTug’s total capital raised to $5.3 million.

The money is intended to bolster OpenTug’s flagship products, BargeOS and LinerOS, which provide automation, real-time tracking, and optimized coordination for the inland and coastal barge sector. With the additional funding, OpenTug plans to further integrate AI and operational optimization into its platform, enhancing visibility and efficiency in maritime freight movement.

“Waterborne freight is the future,” Aristides said in a statement announcing the outside funding. “This investment validates our progress and the enormous potential in digitalizing marine logistics. With TMV’s support, we’re committed to transforming freight transportation from major coastal ports to the smallest inland terminals.”

The money will also support hiring initiatives in engineering, product development, and customer success, company officials said.

BargeOS is software specifically designed to increase efficiency and visibility in tug and barge operations by enhancing customers’ booking, quoting, and tracking abilities.

For shippers, BargeOS offers shippers accurate cost estimation tools to make informed financial decisions, route planning, flexible route adjustments, integrated tracking and updates, and data-driven cost insights. The software can also point out “where you are having the most struggles,” said Baldwin, and increase customers’ “accessibility to data.”

The software can also use quoting and tracking to monitor both a shipment’s status and cost, analyze custom data insights, optimize future quotes, review past voyages, and produce accurate, data-driven quoting.

With the use of tracking devices, a barge company can provide its customers with accurate updates, designed to build trust through transparency, reduce operational costs, again, through efficiency, and support business growth. “Better data involving barge costs and delivery allows companies to ultimately move more barges,” said Baldwin. “And having that data all in one place saves time. You don’t have to go looking across multiple platforms.”

Larger carriers — ACBL, Ingram, etc. — that have hundreds, thousands of pieces of equipment, probably have developed some of their own technology. OpenTug’s software can enhance what’s already in use and, maybe even improve upon it.

However, other barge companies, the so-called mom-and-pop carriers — have much smaller fleets and much smaller budgets and have been left out of the technology boom for the most part. “This is affordable for them,” said Baldwin, “and we try to make the process as easy as possible for them to adopt — as user-friendly as possible.”