New York State finalized new contracts for the Empire Wind and Sunrise Wind offshore projects, Gov. Kathy Hochul announced June 4. The new agreements keep New York’s flagship wind projects on track, after the developers in October sought higher prices to meet their reality of sharply rising costs.

“At a strike price of $155.00 per MW/h Empire Wind 1 is expected to deliver forward looking real base project returns within the guided range for renewable projects,” Equinor officials said in a statement welcoming the new contract. “Following a final investment decision, Equinor plans to use project financing, with financial close anticipated by end of 2024. Equinor intends to bring in a partner to reduce financial exposure.”

The first signals of retrenchment among New York developers emerged just weeks before Ørsted’s sudden withdrawal from its Ocean Wind 1 project off New Jersey.

In October 2023, developers of Empire Wind proposed raising the “strike price” for Empire Wind 1 from $118.38 per megawatt-hour (MWh) to $159.64/MWh, according to filings then from the New York State Energy Research and Development Authority.

Meanwhile for their Sunrise Wind project, developers Ørsted and Eversource sought a 27% step-up, from $110.37/MWh to $139.99/MWh. At the time, the New York State Energy Research and Development Authority said developers “cite an unexpected and unforeseeable rise in inflation and supply chain costs and constraints associated with, among other things, the Covid-19 pandemic and the Russian invasion of Ukraine.” As a result, NYSERDA acknowledged that the projects were “no longer be economically viable under existing contract pricing terms.”

Then in March 2024 Hochul’s office and NYSERDA officials announced they had a new deal for both Sunrise and Empire.

“The average bill impact for customers over the life of these projects under these awards will be approximately 2%, or about $2.09 per month,” according to a March summary by Hochul’s office. “The weighted average all-in development cost of the awarded offshore wind projects over the life of the contracts is $150.15 per megawatt-hour which is on-par with the latest market prices.”

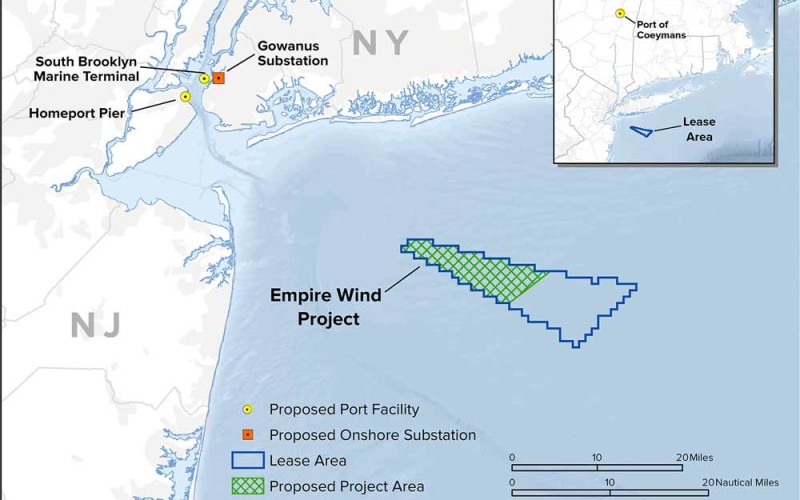

Together the projects have a maximum nameplate rating over 1,700 MW toward New York’s goal of developing goal to develop 9,000 MW of offshore wind energy by 2035. According to the National Renewable Energy Laboratory, long-term average power output, called capacity factor, for offshore wind turbines in the North Atlantic are estimated to be around 45%.

“New York is leading the nation to build the clean energy industry, create good-paying jobs, and advance our climate goals,” Hochul said in her Tuesday announcement. “Offshore wind is a critical piece of our clean energy blueprint to address the climate crisis, and our investments are building a healthy, sustainable New York so that future generations can thrive.”

“As the largest power generation projects in the State in over thirty-five years, these landmark projects, when built, will be a historic milepost in New York’s transition to a clean energy economy,” said NYSERDA president and CEO Doreen M. Harris.” Achieving a zero-emissions electric grid will deliver significant economic and public health benefits as well as reliability to all New Yorkers.”

State officials say they negotiated new provisions for the contracts, including:

- New economic benefit commitments above what was originally contracted, including $32 million committed to community-focused investments in New York’s disadvantaged communities and $16.5 million towards wildlife and fisheries monitoring.

- Commitments to purchasing a minimum of $188 million of U.S. iron and steel, supporting U.S. manufacturing and the New York Buy American Act

- Requirements for Labor Peace Agreements for operations and maintenance services.

“At a strike price of $155.00 per MW/h Empire Wind 1 is expected to deliver forward looking real base project returns within the guided range for renewable projects,” according to Equinor. “Following a final investment decision, Equinor plans to use project financing, with financial close anticipated by end of 2024. Equinor intends to bring in a partner to reduce financial exposure.