Energy major BP is spending $1.1 billion to acquire a 50 percent ownership with Norway-based offshore wind developer Equinor in its two Northeast U.S. waters projects, for what the companies call “a strategic partnership for future growth.”

The deal commits BP and Equinor to share in developing the Empire Wind lease area outside the New York Harbor approaches, and the Beacon Wind lease located south of Massachusetts.

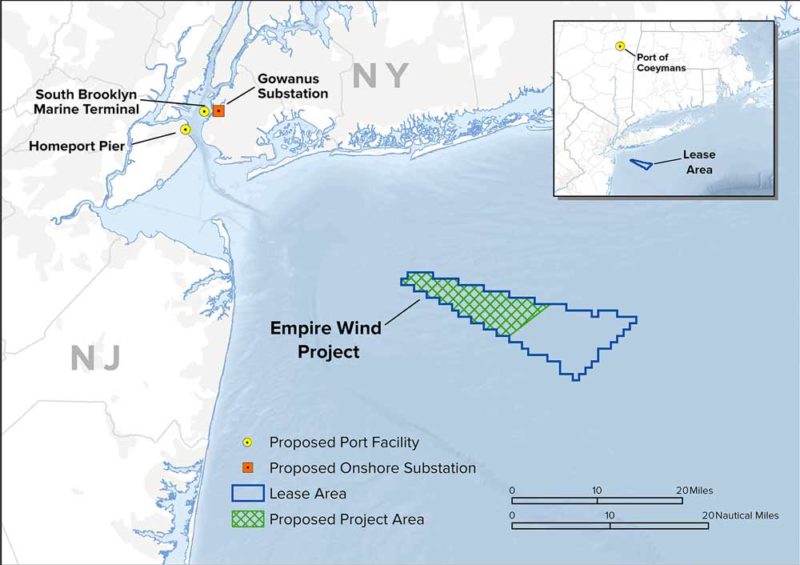

Equinor acquired one of the earliest U.S. East Coast wind power leases in 2017 with the Empire Wind site, an 80,000-acre triangle wedged between two of the main ship traffic lanes for New York Harbor. The Beacon Wind lease is 128,000 acres about 20 miles south of Nantucket, Mass.

The BP deal “is in line with Equinor’s renewable strategy to access attractive acreage early and at scale, mature projects, and capture value by de-risking high equity ownership positions,” according to an Equinor statement. “Equinor will remain the operator of the projects in these leases through the development, construction and operations phases and it is anticipated that the wind farms will be equally staffed after a period of time.”

This is the first move into offshore wind for BP, whose CEO Bernard Looney has said his company will be investing up to $5 billion a year in developing renewable energy while reducing its oil and gas production by 40 percent through 2030.

“This is an important early step in the delivery of our new strategy and pivot to truly becoming an integrated energy company,” Looney said in announcing the partnership agreement. “Offshore wind is growing at around 20 percent a year globally and recognized as being a core part of the world’s need to limit emissions.”

In the northern European offshore wind market, Equinor and other players are likewise trading assets. In October 2019 Equinor announced it was selling half of its interest after building the Arkona wind power array in the Baltic Sea off Germany, to Credit Suisse Energy Infrastructure Partners for $500 million.

Equinor said the deal to bring institutional investors into the project “captured value” for Equinor’s work.

“This divestment demonstrates Equinor’s ability to realize value from the development of offshore wind projects. Active portfolio management through the project life cycle is an important part of our offshore wind strategy,” said Pål Eitrheim, executive vice president of new energy solutions at Equinor, at the time.

“Arkona was delivered under budget and on time and has had strong operational performance since start-up. Now the project is de-risked and in the early phase of operations, and we are pleased to welcome Credit Suisse Energy Infrastructure Partners as new partner.”

Equinor and BP said they will look together for emerging opportunities in U.S. waters for both seafloor foundation wind turbines on the continental shelf – the Empire Wind site has depths from 65 feet to 131 feet – and floating turbines in deeper waters.

BP’s acquisition should close in early 2021 after purchase price adjustments and regulatory approvals.