Global efforts to reduce carbon emissions are accelerating and most industries are searching for new ways to reduce their carbon footprint in the years and decades to come.

Shipping is also under scrutiny and the International Maritime Organization (IMO) has set a carbon intensity reduction target, proposing strict technical requirements that are scheduled to be approved this year and take effect from 2023. One of the effects of these new requirements is likely to involve slow-speeding – a reduction of the maximum cruising speed of deep-sea vessels in a bid to reduce emissions.

Despite the regulator’s good intensions, a Rystad Energy investigation reveals that if the IMO’s proposed technical requirements are applied on the world’s fleet of liquefied natural gas (LNG) carriers, the net result for the planet will be negative, as the global savings in the vessels’ CO2 emissions will be dwarfed by the pollution from gas-to-coal switching that the move would cause in Asia.

To comply with the requirements and achieve the IMO’s goal to reduce the carbon intensity of the shipping industry by 40% by 2030 compared to 2008 levels, Rystad Energy finds the most viable and cheapest option for steamers and slow-speed diesel (SSD) vessels is to limit their maximum speed to 15 knots, as these types of vessels constitute the highest emission rate per ton-mile travelled. Any of the other possible alternatives – such as scrapping and replacing vessels or modifying them – would be significantly more expensive.

The requirement is a considerable hurdle for the LNG shipping industry as approximately half of its current global fleet of 600 carriers are steamers or SSD vessels, and empirical data shows that an average LNG tanker travels at above 15 knots about 50% of the time. Although the speed limit would result in lower emission levels for the global fleet, it would also lead to a 3% average yearly shortfall in relation to the volume of ton-miles needed to satisfy LNG demand from 2023 to 2030.

Even if the fleet’s utilization improves by reducing the idle time for LNG carriers to a minimum – which could nearly nullify the effect on LNG deliveries to storage-flexible and well-interconnected Europe – it would still lead to an average yearly reduction of at least 1% in ton-miles that would affect the deliveries to Asia, the world’s largest consumer of LNG at continent level.

Meeting Asian LNG demand in the future will already be a challenge prior to any new emission restrictions by the IMO*. Rystad Energy’s analysis shows that if the global LNG carrier fleet meets the growing ton-mile demand to satisfy Asia’s needed LNG imports this decade, adopting the IMO’s proposal would then strip Asia of at least 9 billion cubic meters (Bcm) of LNG for the three-year period between 2023 and 2025 and by 13 Bcm from 2026 through 2030.

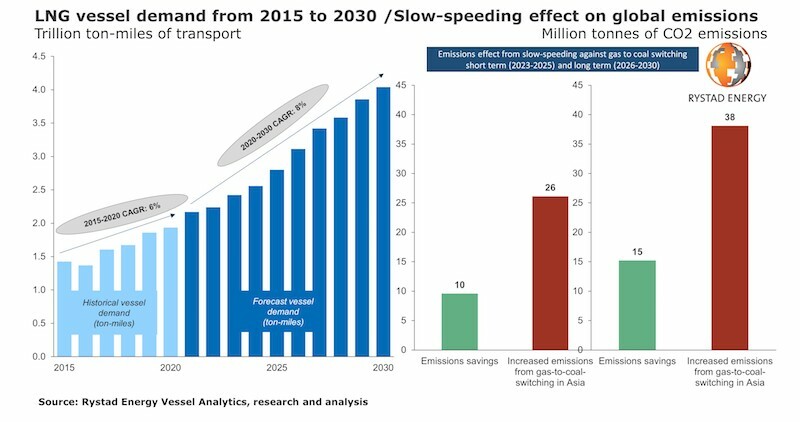

Rystad Energy’s research shows that the accumulated emission savings from LNG vessels in the 2023-2025 period will amount to about 10 million tonnes (Mt) of CO2, far lower than the extra 26 Mt of CO2 that replacing the missed LNG imports with coal will generate. For 2026-2030, the fleet’s emission savings would total 15 Mt of CO2, still low when compared with the extra 38 Mt of emitted CO2 that will be caused by the increased burning of coal to substitute lost LNG volumes.

“To offset the emitted CO2 from gas-to-coal switching and actually make IMO’s target meaningful for LNG vessels, a very large proportion of the lost LNG would need to be replaced through further expansion of renewable energy capacity in Asia,” said Oddmund Føre, vice president in Rystad Energy’s energy service research team.

Rystad’s scenario is rather conservative, Føre points out, and the IMO target could likely result in an even worse net footprint: “It is also likely that the proposed regulations would lead to the retirement of numerous LNG carriers. Scrapping would remove fleet capacity and exacerbate the problem in Asia, as even less gas would arrive and more gas-to-coal switching would take place. Furthermore, this would cause higher utilization and day rates for LNG vessels, thus lifting LNG delivery prices and potentially contributing to even greater consumption of coal for cost reasons.”

The use of coal in power generation has been a significant driver behind the increase of energy-related CO2 emissions in Asia – from 8 billion tonnes in 2000 to 17 billion tonnes in 2019 – while the corresponding tally for the rest of the world increased from 16 billion to 17 billion tonnes in the same period. Given that coal has two to three times higher carbon intensity than gas per unit of power generated, coal-to-gas switching in power generation stands as a critical element in the global drive to reduce emissions.

Gas-to-coal switching is typically higher when the price of gas is high, while we see less use of coal when gas prices are low. Gas-to-coal switching is a phenomenon year-round in Asia but is more pronounced during cold winters due to higher gas prices. Since 40% of gas consumption in Asia is met by imported LNG, for which there is very limited storage capacity, prices tend to rise in periods of higher demand for gas. This means that even though gas power generation capacity has grown faster than actual generation in recent years, thus providing significant room to increase the use of gas in the power mix, such coal-to-gas switching will be very dependent on LNG prices and access.

With LNG imports expected to cover about 50% of Asian gas demand in 2030, and with the Asian sector forecast to constitute 75% of the global LNG market, the IMO’s requirements will have a significant impact on the shipping market. LNG vessel demand is forecast to increase from approximately 2 trillion ton-miles in 2020 to 4 trillion ton-miles in 2030. This equates to a yearly growth rate of 8%, a considerable acceleration compared to the growth rate of 6% seen from 2015 to 2020. Larger volumes and longer sailing distances have caused this increase in demand for LNG carriers in the current decade.

*Based on the average distance sailed by LNG carriers in recent years, it is evident that the current LNG carrier fleet and yard orderbook capacity will not be sufficient to meet the surge in ton-mile demand. Rystad Energy’s team expects to see a record high 64 newbuild vessels delivered by shipyards in 2021. That is also the number needed on an annual basis to ensure sufficient capacity to meet the rising demand for ton-miles towards 2030. Yet, such a high pace of new deliveries over several consecutive years will be a major challenge due to capacity limitations, as qualified shipyards can presently build around 57 units per year.

The reason for the higher number of deliveries this year is that many newbuild programs have been delayed in recent years due to market turbulence, causing a backlog of nearly completed LNG carriers that now are finally making it across the finish line. If the world lacks the number of vessels needed to feed Asia’s LNG demand in the future, even more coal will likely be used to replace the lost gas, leading to more energy emissions.