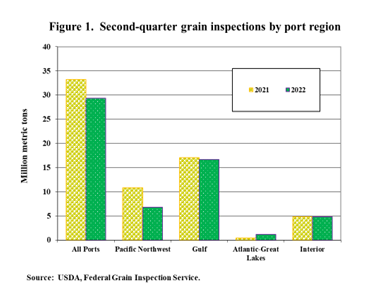

During second quarter 2022, inspections of wheat, corn, and soybeans for export from all major U.S. ports totaled 29.4 million metric tons (mmt), according to the U.S. Department of Agriculture's Federal Grain Inspection Service (FGIS).

The amount of grain inspected was down 4% from the five-year average and down 11% from second quarter 2021 (year to year). Inspections of grain were down in two major U.S. port regions. In July, USDA estimated MY (market year) 2021/22 exports will be down 11% for corn, 4% for soybeans, and 19% for wheat, from MY 2020/21.

In the second quarter 2022, Pacific Northwest (PNW) grain inspections totaled 6.8 mmt, down 37% year to year and down 33% from the five-year average. Second-quarter rail deliveries of grain to PNW ports were down 6% year to year.

At 16.7 mmt, grain inspections in the U.S. Gulf fell 3%year to year and rose 9% from the five-year average. The year-to-year decline mainly reflected a drop in corn and wheat inspections. Rail deliveries of grain to Mississippi Gulf ports increased 39% year to year, and barge grain movements on the Mississippi River to the U.S. Gulf fell 19%. Atlantic-Great Lakes. At 1.2 mmt, grain inspections in the Atlantic-Great Lakes were up significantly year to year and up 52% from the five-year average.

Interior grain inspections were 4.8 mmt, nearly unchanged from year to year and up 9% from the five-year average. Corn and soybean inspections in the interior remained strong during second quarter 2022. Of total interior inspections, corn inspections represented 53%, and soybean inspections represented 34%.

Second-quarter corn inspections were 17.5 mmt, down 24% year to year and up 1% from the five-year average. The year-to-year decline in corn inspections was due primarily to decreased demand from China and Japan. PNW corn inspections were 4.5 mmt, down 32% year to year and down 13% from the five-year average. At 10.3 mmt, U.S. Gulf inspections of corn decreased 25% year to year and increased 7% from the five-year average. Corn inspections in the interior were 2.6 mmt, down 7% year to year and up 4% from the five-year average. Corn inspections in the Atlantic-Great Lakes sharply increased, more than 432% of last year’s total.

Second-quarter soybean inspections were up significantly from last year. At 7.6 mmt, soybean inspections were up 150% year to year and up 25% from the five-year average. The large increase in soybean inspections was due mainly to higher shipments to China and other countries in Africa and Europe. During the second quarter, PNW soybean inspections reached 0.565 mmt, up 927% year to year, but 42% below the five-year average. At 4.5 mmt, second-quarter U.S. Gulf soybean inspections were up 115% year to year and up 41% from the five-year average. At 1.6 mmt, interior inspections of soybeans were up 22% year to year and up 11% from the five-year average.

Second-quarter wheat inspections were 4.3 mmt, down 39% year to year and down 40% from the five-year average. At 1.7 mmt, second-quarter wheat inspections in PNW marked the lowest on record: down 58% year to year and 56% from the five-year average. Total wheat inspections in the U.S. Gulf were down 10% year to year and 26% from the five-year average. Atlantic-Great Lakes wheat inspections hit a record low at 0.113 mmt — down 44% from year to year. At 0.636 mmt, interior second-quarter wheat inspections were the region’s second highest on record. This total was up 29% from the five-year average and down 22% year to year, primarily because of decreased shipments to Canada, China, and Mexico.

The USDA’s July World Agricultural Supply and Demand Estimates (WASDE) projected corn exports in MY 2022/23 to be 60.96 mmt, a 2% decline in corn exports from the MY 2021/22 total. In the same report, USDA projected soybean exports in MY 2022/23 to be 58.11 mmt, a 2% decline from the MY 2021/22 total. USDA also projected MY 2022/23 wheat exports to be 21.77 mmt, unchanged from the MY 2021/2022 total. Corn projections remain unchanged, soybean projections decreased, and wheat projections increased from projections in the June WASDE report.